This column first appeared in Broad + Liberty.

The phrase “perfect storm” is frequently overused, but in the case of Upper Darby Township, it’s completely accurate.

New tax increases for the municipal government and school district are imminent due to questionable spending by both authorities. When you combine these tax increases with irresponsible, unfunded spending at the county level, the already overtaxed residents of Upper Darby are about to pick up the tab for the gross negligence of their administration.

I ask that you indulge me and permit me to set the stage here with some history.

I served as chairman of Upper Darby’s township economic development organization from 2018–2020. Appointed by Mayor Thomas Miccozzie and approved by the council, my committee was charged with assessing the relative economic competitiveness of the commonwealth’s sixth-largest municipality and advising the administration on steps it could take to strengthen the local economy and the municipal government’s overall fiscal position.

My analysis in 2018 was simple: Upper Darby residents are victims of both Pennsylvania’s unfair, archaic, and balkanized system of local taxation and a completely irrational tax structure in neighboring Philadelphia that chases out private capital and exacerbates poverty in the nation’s poorest big city. Proponents of the city wage tax and its defenders in Harrisburg have, over time, created a system that punishes the vulnerable, promotes the flight of families and businesses, and widens the economic gap between the rich and poor.

These compounding forces create a dynamic where Upper Darby families and businesses are incentivized to flee to environs where real estate taxes represent a smaller percentage of the value of their homes and where real estate values are less likely to decline due to excessive tax burdens that consume the home equity of working families.

My conclusion was equally simple: Though the town faced major structural challenges, a death spiral could be avoided with the right mix of policy leadership, strong fiscal management, and community engagement. However, two things had to happen.

First, we had to grow our way out of the problem by attracting new businesses and private investment. This would create economic opportunities for residents and allow the government to shift some of the local tax burden away from working families. Developing the 69th Street commercial corridor, the Drexeline Town Center, and the township’s various local business districts were essential to success.

Second, we needed to work closely with the Pennsylvania Department of Community and Economic Development so they would better understand the structural challenges that undermined urban, working-class municipalities like Upper Darby all across Pennsylvania. Their partnership could mean access to the sort of state subsidies, such as Keystone Opportunity Zones, that rejuvenated many struggling neighborhoods in the city.

As a result, Upper Darby became the first municipality in the commonwealth to enter the state’s Strategic Township Management program in 2019. We were provided a grant to develop an economic development strategy to not just stave off disaster but also reimagine the local economy. The work had the full support of the Micozzie Administration and a large majority of the town council, but the support was not unanimous.

Then-Councilwoman Barabrann Keffer dismissed the plan as a distraction at a public hearing and refused to support it. She would go on to be elected mayor later in 2019, and a few months into her term, she dismantled the committee entirely and the township’s engagement with the Strategic Township Management Program. The Drexeline Town Center project was stalled. In 2020’s summer of rage, riots decimated the 69th Street commercial corridor. And the new administration repeatedly demonstrated incompetence in managing its fiscal affairs, including the mishandling of federal funds that led to the resignation of Keffer’s chief administrator.

Perhaps Mayor Keffer regrets that decision today.

Four years later, on Sept. 20, 2023, Mayor Keffer called a town hall to inform the Upper Darby Township residents that the administration had entered the Department of Community and Economic Development’s Strategic Township Management Program. They had received a grant to work with a consultant to assess the township’s local economy and financial position. The consultant’s findings were dire: the administration failed to conduct the proper audits and misspent funds, diminishing its capacity to borrow. Years of poor fiscal management and declining revenues will yield structural deficits for the foreseeable future unless new, regressive taxes are thrust upon residents, many of whom are struggling to afford the current tax burden.

Go figure.

The administration’s presentation was unsettling for several reasons. First, as I have outlined above, despite the obvious challenges, this predicament was entirely avoidable. Second, close observers of Delaware County politics from both sides of the aisle quietly admit that the administration has been a disaster in every sense of the word. Third, and most importantly, it was what the presentation did not say that was most unsettling. The administration’s analysis failed to account for how the other taxing authorities were managing their affairs, which is no small matter. In short, the town is indisputably on the precipice of financial Armageddon.

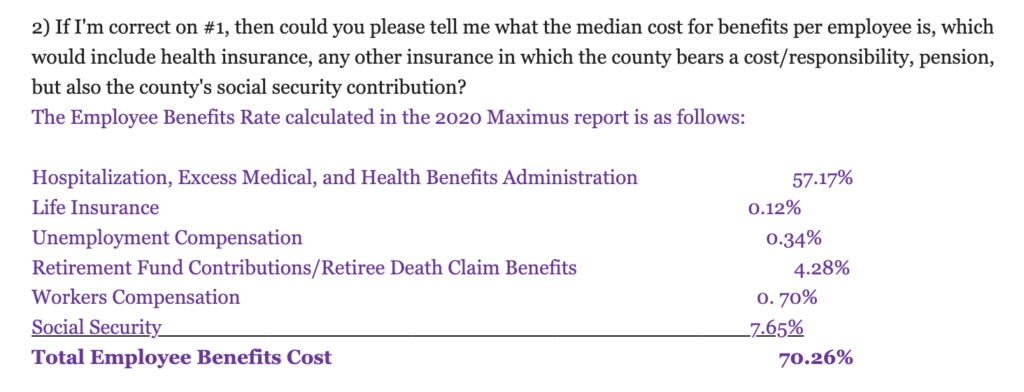

The median household income in Upper Darby is $62,500 and the median value of an owner-occupied home is $207,500 (according to censusreporter.org). The owner of the house is obligated to pay real estate taxes to three government entities: the township, school district, and county. The total taxes currently levied by those three entities is 42.1414 mills. A median-priced house is taxed $8,744 annually, which is equal to fourteen percent of the median household income. Homeowners are reaching the breaking point. Add insurance, repairs, utilities, and home ownership, and it is becoming close to unaffordable for a working-class family, as it has been for seniors on fixed incomes for some time.

Things have been difficult for homeowners in Upper Darby, but they are about to get considerably worse.

The school district passed its most recent budget using $20 million in money given to the district by the federal government to help with expenses incurred because of the Covid-19 pandemic. The problem is the money was largely used to add recurring costs, such as personnel. There will be no $20 million from the federal government in next year’s budget, so the district is confronted with a $20 million structural deficit. Guess where they are most likely to go to get that money? Even with the $20 million in federal funds, the district still needed a tax increase and money from its “rainy day” fund to balance its budget this year.

In addition, the district has decided to double its current debt load and build a new school costing at least $100M. In order to build it, they will need to issue bonds; the annual cost of those bonds will be $7M. The district will no doubt have inflation adjustments of several million to the next budget in addition to the bonds and the unfunded deficit. If we add all these up, there is a likely need for more than a $30M increase in school taxes.

Of course, they could cancel the new school and lay off a significant number of employees. They could, but probably cannot or will not. If my worst case comes true, the district could find it must raise taxes by six mills or more — that’s $1,200 on the median home.

This brings us back to the township. According to its presentation, the municipal government is basically bankrupt. The township deficit will be $11M within eighteen months. The causes of the condition are complex but certainly include a large dose of mis-, mal-, and nonfeasance.

For instance, more than a million and a half dollars went to lawyers, including a Montgomery County lawyer who happens to be, according to The Philadelphia Inquirer, one of the largest contributors to local Democrats. That number is higher than the entire county government spent on outside legal fees in 2019, the last year of GOP control.

You might ask, are the hundreds of thousands of dollars in missing parking fees the only example of official legerdemain? Further, do you feel safer in Upper Darby today than in 2019? Given that the number of homicides has more than tripled under this administration’s watch, spending a bit more on police and a bit less on lawyers seems like a good idea.

By the way, the argument that the township lost any meaningful amount of revenue during the pandemic is preposterous given its tax structure. Local real estate taxes represent the vast majority of total revenue. During the Covid lockdowns, the federal government made mortgage payments, inclusive of property taxes, for those who could not, while the township government itself operated at reduced capacity (e.g. cost). The pandemic cannot be blamed for this problem with a straight face.

If we add the $11M the township needs to the $30M the school district needs we are up to a $41M structural deficit. But WAIT! It does not end there!

Our betters in Media will also need more of Upper Darby residents’ hard-earned dollars; after all, they know so much better how to spend it. The County Council has already acknowledged publicly that they will need to seek “new revenues.” If our estimates at Broad + Liberty are correct, their forthcoming $60M structural deficit will add approximately $5M to Upper Darby’s real estate tax burden.

Let’s sum this up: $30M (Upper Darby School District) + $11M (Upper Darby Township) + $5M (Delaware County) equals a $46M structural deficit. The additional ten mills required to cover this deficit will mean Upper Darby’s relative tax burden will be 32 percent higher than Swarthmore (35 mills), 61 percent higher than Media (20 mills), 63 percent higher than Radnor (19 mills), and an eye-popping 69 percent higher than Newtown Township (16 mills). Where are the local progressives demanding the affluent pay their fair share? Well, by and large, they live in those towns. Meanwhile, in Upper Darby, the owner of the average home will pay an additional $2,000 in local taxes.

Plus, the administration has proposed levying a new earned income tax, which it intends to split with the school district. A policy that will undoubtedly drive income earners to flee to nearby Haverford, Springfield, and Marple Townships in droves. Its yield to the government is likely to be a fraction of current estimates.

I welcome those running the township, school district, and county to challenge my numbers. I hope, for the good of the town, they will prove me wrong.

I suspect they will not, because they cannot.

Whether by evil genius or complete incompetence, those responsible for being good stewards of our tax dollars have failed the residents of Upper Darby miserably and, given the state of the schools, streets, and parks, have precious little to show for it. Luckily most have yards big enough for a garden — that’s if they want to eat.