Veteran Winkler Hopes to Keep Serving, This Time in Congress

David Winkler says he believes he has a good chance of beating three-term incumbent Congresswoman Madeleine Dean (D-Montgomery) in November.

Winkler is running for Congress because he cares “deeply about America.” He served in the U.S. Marine Corps and fought in Iraq and Afghanistan. After leaving the Marines, he joined the Army.

“A lot of people died to preserve our freedoms and way of life,” said Winkler. “I feel like right now our government is failing the people. And that it’s my duty to stand up and fix it.”

His changes have improved because of the rising popularity of former President Donald Trump, whose coattails might lift down-ballot Republicans.

And, the first-time Republican candidate notes that Dean’s far-left votes against Israel and pro-Palestinians have alienated a sizable portion of the area’s Jewish voters. According to the Jewish Federation of Philadelphia, Jews comprise about 10 percent of Montgomery County residents.

Dean is “one of the most divisive people we have in the government,” said Winkler, 38. “Everything she’s done has torn America apart, from her volunteering to be an impeachment manager to her voting record, even at what’s happened with the Jewish community, the blatant antisemitism. We need people in D.C. who bring people together, not divide… She only caters to the far left.”

Commentary magazine editor John Podhoretz wrote in June that Trump is poised to get more support from Jews than any Republican presidential candidate in modern history due to Biden’s lukewarm support of Israel. He noted a drop in votes for Democrats from Pennsylvania Jews “may be the game right here.”

Rabbi Matthew Adelson, a Conservative rabbi and member of the Philadelphia Board of Rabbis, supports Winkler for Winkler’s position backing Israel.

“David is a wonderful person,” said Abelson. After he met Winkler, “it became very clear to me that he’s someone who is capable of leading on that very critical issue.”

In the months since the Oct. 7 Hamas terror attacks, Dean has “made it very clear she is not a supporter of Israel,” said Adelson, who cataloged a long list of Dean’s pro-Palestinian votes.

“On Nov. 7, there was an opportunity to censure (Rep.) Rashida Talib (D-Mich.) for promoting false narratives regarding the Oct. 7 attack, and (Dean) voted no,” said Adelson. “She allowed funds to go to Iran, and voted against putting sanctions on Qatar.” Iran funds Hamas, and Qatar has given money and sanctuary to its leaders.

“In December, she did not condemn antisemitism on university campuses amid the testimony of university presidents to Congress,” Abelson said. “She voted no on the Israel security supplemental Appropriations Act on Feb. 24. She called for a ceasefire with Hamas on Feb. 29.”

On April 5, Dean voted with members of the “Squad” to cut U.S. military aid to Israel.

“And she wrote a letter asking Biden to ‘use all the tools’ there are to prevent Israel from going into Rafah,” he said. “When the IDF did go into Rafah, they found tunnels between Rafah and Egypt, which is a grave concern.”

“On April 16, around Passover, she voted present when there was an opportunity to condemn the slogan ‘From the river to the sea, Palestine will be free,’ which is clearly genocidal,” he added. In May, she backed Biden’s withholding of offensive weapons from Israel.

And in July, Dean “rose on the House floor” to say the United Nations Relief and Works Agency for Palestine (UNRWA), which is anti-Israel with employees who took part in the Hamas terror attack, “is doing ‘God’s work,’” said Abelson.

“It’s very obvious she doesn’t have the back of her Jewish constituents,” he said.

Christian Nascimento, chair of the Montgomery County Republican Committee, said, “Whether it is her doubling down on support for Joe Biden after the recent debate debacle or her one-sided approach to the Israeli-Hamas conflict, Rep. Dean has shown that her far-left views are outside the mainstream of Montgomery County voters. In David Winkler, we have a candidate that has a commonsense approach and a different perspective as a person of color and a veteran – a perspective that better aligns with the majority of residents of the 4th Congressional district.”

Winker also holds Dean, who sits on the foreign affairs committee, partly responsible for the disastrous American withdrawal from Afghanistan, where 13 U.S. troops died in a suicide bombing at Abbey Gate near the Kabul airport.

“She should have been able to push back on Biden to keep Bagram Air Base open,” he added. He noted military equipment worth billions was left behind, but more importantly, so were American citizens and Afghans who helped Americans.

“One of those was my interpreter,” said Winkler. “This was a complete failure of the U.S. State Department and the Department of Defense.” His interpreter is still trapped in Afghanistan.

That withdrawal is “one of the reasons I’m running. Once a Marine, always a Marine. Semper Fi. We don’t leave people behind.”

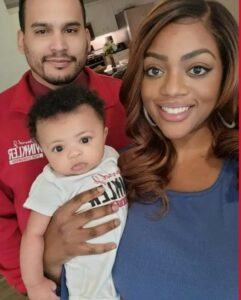

Winkler was a biracial foster child who was adopted by “two loving White parents.” His father was an engineer with Raytheon, then a merchant marine. Winkler grew up in Canada, southern California, and Northern Ireland. Winkler joined the Marines when he turned 18. He also worked as a police officer in Murfreesboro, Tenn. and led a nonprofit, Wings for Warriors. He moved to Montgomery County in 2021 after marrying his wife, Kay, who grew up here. She is a first-generation American whose family came from Sierra Leone. The Winklers, who live in Elkins Park, are raising a stepdaughter and a baby son. David Winkler currently employed as a property manager.

“I’m just a pissed-off veteran,” said Winkler. “You can call it MAGA. You can call it whatever you want. I’m just very commonsense.”

Please follow DVJournal on social media: Twitter@DVJournal or Facebook.com/DelawareValleyJournal