Sen. Casey Tight-Lipped Over Potential Stock Sale Reporting Violation

This article first appeared in Broad + Liberty

Sen. Bob Casey (D) is refusing to add any explanation or clarification to his legally required disclosure of a stock sale which clearly appears to have been filed well outside of the mandatory 45-day reporting window.

The delayed reporting raises numerous ethical questions, especially given that in between the transaction and the time it was reported to the Senate Ethics Office, a subsidiary of the energy company in question was telling Energy Secretary Rick Perry a potential bankruptcy was likely and requested federal assistance to help keep some of its power plants operating.

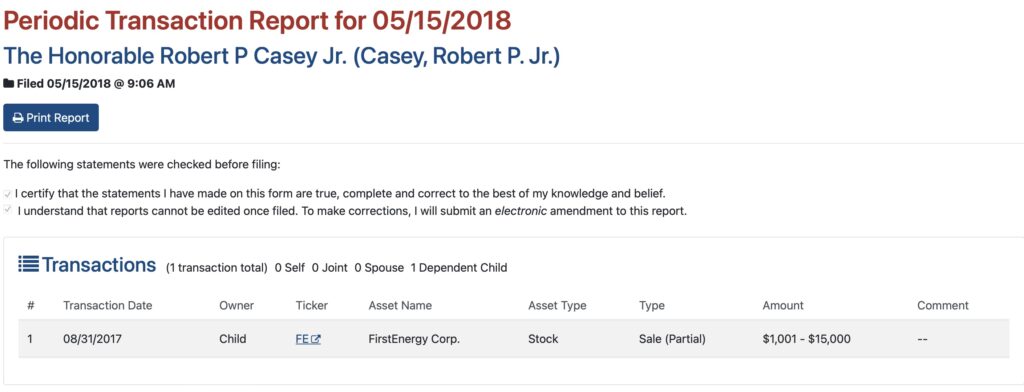

The Senate ethics disclosure site shows Casey filed the “periodic transaction” report in May 2018, establishing that a dependent child of his sold somewhere between $1,000 and $15,000 worth of stock in FirstEnergy Corp. The website also shows, however, that the sale occurred eight months earlier on Aug. 31, 2017.

The STOCK Act, signed into law in 2012, updated previous ethics laws, and requires certain federal elected officials “to file reports within 30 to 45 days after receiving notice of a purchase, sale, or exchange which exceeds $1,000 in stock[.]”

The STOCK Act, signed into law in 2012, updated previous ethics laws, and requires certain federal elected officials “to file reports within 30 to 45 days after receiving notice of a purchase, sale, or exchange which exceeds $1,000 in stock[.]”For a stock sale conducted on Aug. 31, 2017, that transaction would need to have been reported by Oct. 15, 2017 to be compliant.

Requests for comment by Broad + Liberty to Casey’s office seeking an explanation of the delayed disclosure were not returned.

FirstEnergy was enduring a period of incredible turmoil in 2017. Rumors swirled for months that one of its subsidiaries, FirstEnergy Solutions, was nearing bankruptcy.

That potential bankruptcy wasn’t all bad for the parent company, however. Some analysts were upgrading their forecasts for the parent company FirstEnergy on the news.

In March 2018, FirstEnergy and its subsidiary notified the federal government it intended to close three of its nuclear power plants, two in Ohio and one in Pennsylvania. Days later, FirstEnergy Solutions made its bankruptcy filing.

“This disclosure law, as well as Senators’ compliance with accurate and timely filing of all required disclosures, is extremely important because it is the only mechanism to determine whether a Senator has a conflict of interest or is wrongfully profiting from their position,” said Kendra Arnold, executive director of Foundation for Accountability and Civic Trust, a DC-based nonprofit focused on transparency and ethics.

“It’s important to note that the Senators’ spouse and dependent children’s financial information are essentially treated as that of the Senator because the Senator may benefit from or actually control those assets,” she added.

“When a Senator does not file accurate or timely information it becomes very difficult, if not impossible, to determine whether the Senator’s personal finances influenced his official actions or the Senator used nonpublic information to profit. The Senator is already given a 30 or 45 day grace period to disclose and there is no excuse for late filings,” Arnold concluded.

Arnold also said given that the late disclosure was years old, it was unlikely that the Senate Ethics Office would investigate.

The late disclosure was first reported by the conservative website Breitbart, which also noted that a FirstEnergy political action committee donated $19,000 to Casey’s campaign committee starting in 2010. The last donation came in January 2018, after the stock sale had happened but the disclosure had not.

FirstEnergy would later go on to become embroiled in one of the largest bribery scandals in U.S. history that involved Ohio elected officials and in no way touched upon Casey.

“Federal prosecutors say that between March 2017 and March 2020, entities related to an unnamed company — but that would appear to be nuclear power company FirstEnergy Solutions — paid approximately $60 million” to a nonprofit controlled by the then-Ohio House Speaker Larry Householder, NPR reported.

Through all of this turmoil, however, FirstEnergy’s stock price made a bullish run from the start of 2018 to the beginning of the coronavirus pandemic in the spring of 2020.