Picozzi’s Transit Worker Safety Bill Passes Senate

On Oct. 26, 2023, SEPTA bus driver Bernard Gribbin was shot dead as he sat behind the wheel of his bus in Germantown. Police arrested a female passenger shortly afterward.

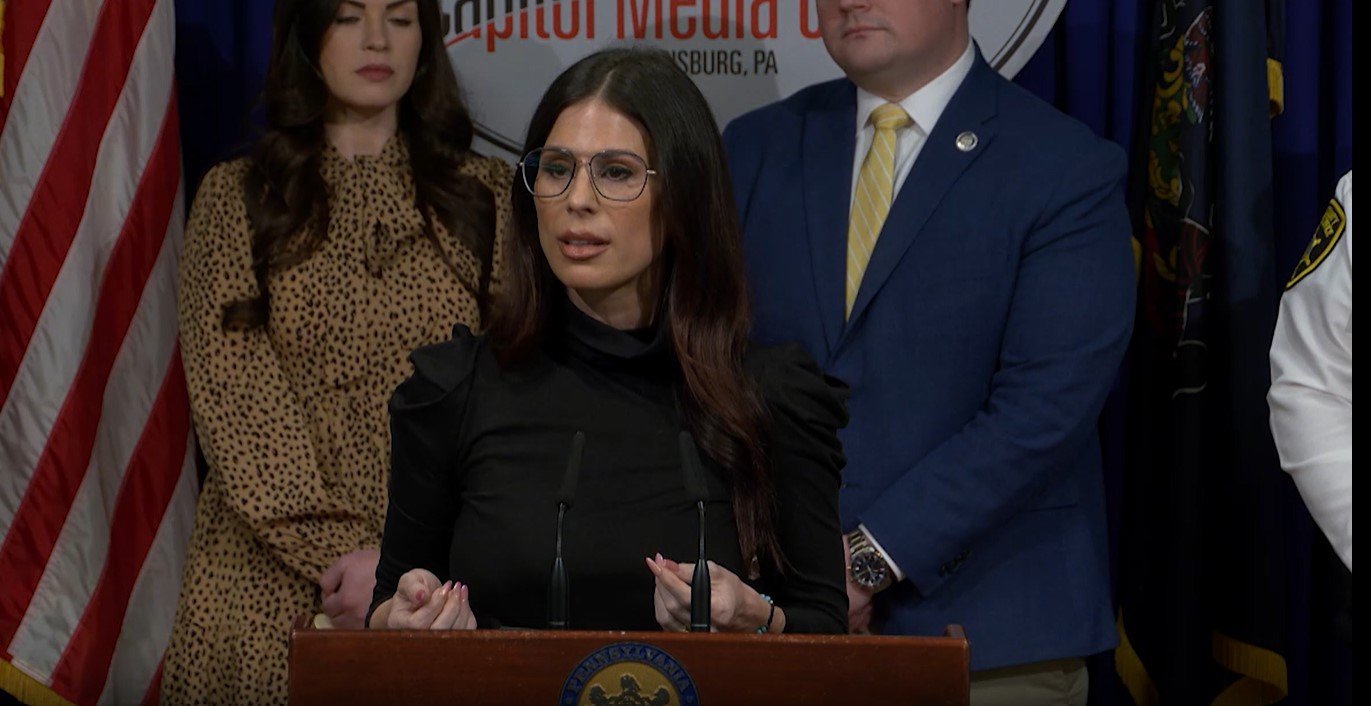

A bill named for Gribbin, sponsored by local state Sen. Joe Picozzi (R-Philadelphia), recently passed the Pennsylvania Senate 48 to 1. It creates a new offense for interference with the operation of a public transit vehicle. Offenders causing serious bodily injury or death would face a felony of the first degree, while interference resulting in bodily injury, or the fear of imminent harm would be classified as a felony of the third degree.

In remarks before the Senate, Picozzi said the “senselessly murdered” Gribbin, a retired Army combat engineer, had worked for SEPTA for 12 years and was “beloved” by his riders.

Those who harm transit workers can also cause accidents in the process, harming members of the public, he added.

SEPTA, the Southeastern Pennsylvania Transit Authority, supports the bill. The legislation sends a strong message that violence against public transit operators will not be tolerated, and those responsible for putting others’ safety at risk will face severe consequences, according to the agency.

Sen. Frank Farry (R-Bucks), who also sponsored the measure, said, “Our transit workers deserve to be safe in their workplace. This bill would not only provide the necessary protections for our hardworking transit employees who provide a critical service to our community and are vital to Pennsylvania but also protect the passengers and other commuters on the roadway.”

Sponsor Sen. Tracy Pennycuick (R-Montgomery) said, “Transit operators across Pennsylvania deserve a safe workplace. In the Southeast, SEPTA operators have faced a rise in assaults and violent incidents. We must take stronger action to protect these workers and ensure that public transit remains safe for both employees and passengers.”

Sen. Tina Tartaglione (D-Philadelphia) said, “Our transit workers keep Pennsylvania moving, yet too many face threats and violence on the job. No one should fear for their safety while simply doing their job,” she continued. “Bernard Gribbin’s tragic death is a stark reminder of the urgency to act. This legislation will give transit workers the protections they deserve and send a clear message—violence against them will not be tolerated.”

The bill is now in the House.

Picozzi also brought the Senate Majority Policy Committee to Kensington for a discussion with the Philadelphia police. Long known as a haven for drug addicts and drug dealers, the City of Philadelphia, under Mayor Cherelle Parker, is taking steps to improve the area.

The state senators then toured Riverview Wellness Village, a nearby recovery-based housing center that Parker created. Riverview provides housing and special services to help those suffering from drug use build sustainable habits for long-term recovery. They are now in the process of adding more beds and workforce development initiatives.

“Public safety is my number one priority, and we are appreciative to our city law enforcement who provided firsthand witness to the challenges they face,” said Picozzi. “It was important for me to share those realities with my colleagues as we explore ways to help keep everyone safer.”

Committee Chair Sen. Dave Argall (R-Carbon) said, “The brave officers we met with yesterday deserve more than just our thanks – they need more support. Sen. Picozzi stressed throughout this visit that the Philadelphia Police and Mayor Parker have made strides toward reducing crime within the city, but they need more help. The persistent deterioration of neighborhoods that we witnessed is completely unacceptable.”