In the wake of a Commonwealth Court ruling on the controversial DELCORA deal, an attorney for the private utility company Aqua sent a letter to the Public Utility Commission (PUC) urging it to “commence expeditiously” toward approving the sale. It is the most recent shot in a legal and political battle going back to 2019.

And yet after mountains of legal filings, multiple political attacks, and partisan name-calling, a key question remains unanswered: Who wins?

If Aqua convinces the PUC to approve its $276.5 million offer to buy DELCORA and the for-profit company takes over service for the 165,000 wastewater customers, is that good news or bad for ratepayers?

Delaware County has convinced the court that it has the authority to dissolve DELCORA and absorb its assets. If it takes over the operation entirely, is that a step forward for customers, or back?

Does the county even want to run the wastewater system? Or would it rather reform DELCORA and leave a quasi-independent agency in charge? Or does the council have another plan: Get Aqua to bump up the price, pocket the extra cash, and dump DELCORA’S customers onto the company’s ledger?

How did the seemingly simple sale of a water treatment system become so fraught with drama? Partisan politics — and lots of money.

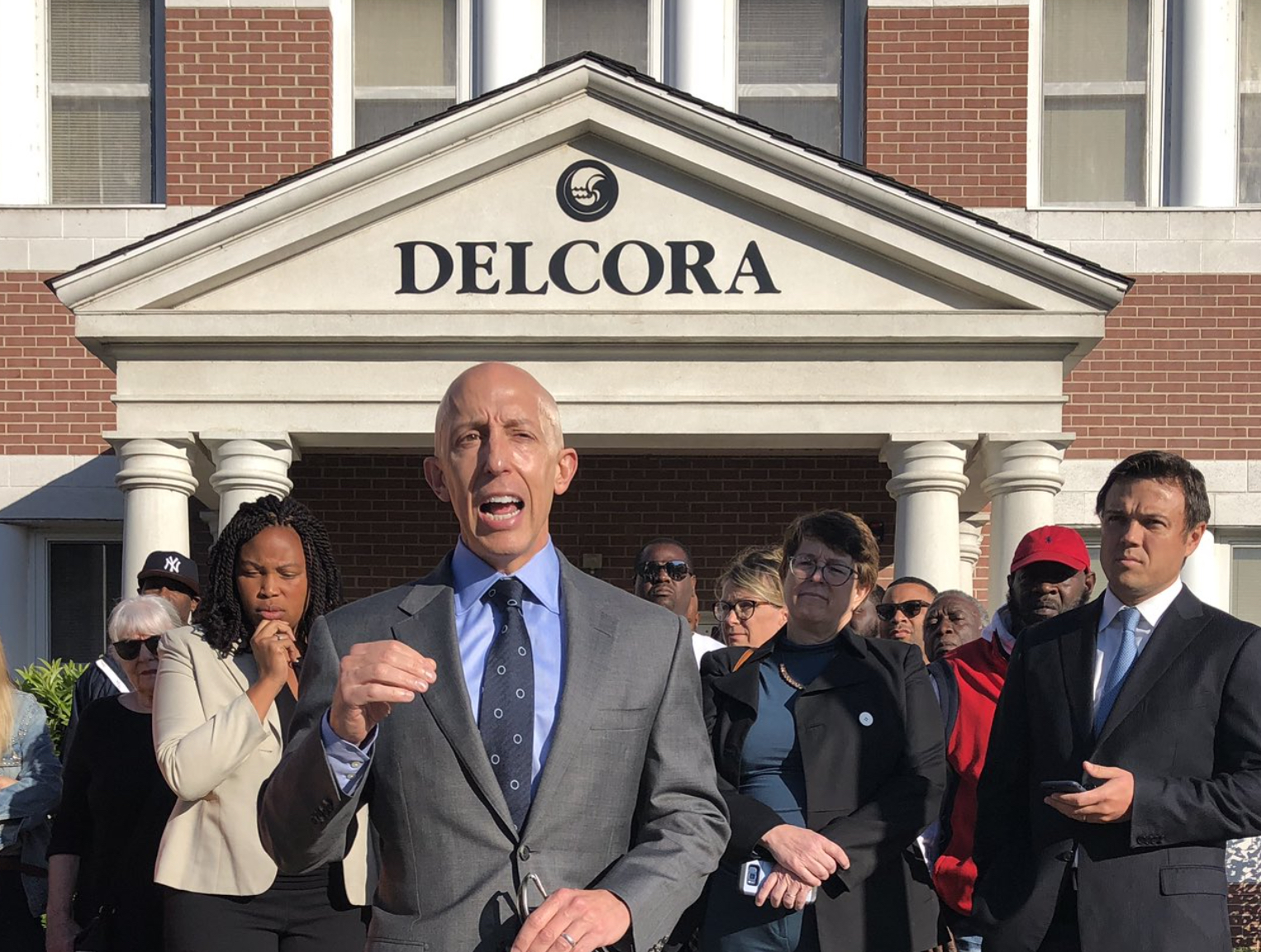

Given the dominance of Democrats in Delaware County politics — there are currently no GOP members on the county council — it is easy to forget Republicans held the majority for decades. In 2019, when Brian Zidek became the first Democrat to chair the Delaware County Council in 150 years, one of his first comments was, “We want to make sure we don’t screw this up.”

One of the first items on the Democrats’ “this” list was the previous GOP-controlled council’s decision to make the DELCORA deal with Aqua on their way out the door. The new Democrat-controlled council went to court in May 2020 to block the sale by terminating DELCORA’s existence.

“From the beginning, I’ve said this deal stunk and the fix was in,” Zidek said at the time. “It was nothing more than a giveaway to a political contributor and the hardworking taxpayers of Delaware County deserve better. With the action we took today, we are advancing our goal of transparency and putting people over politics.”

Nearly two years later, the Commonwealth Court ruled that the council does have the power to terminate DELCORA. However, as Aqua pointed out in its letter to the PUC, the court also said the deal is still in play. Whether or not the goal was to protect GOP patronage jobs, the county is bound by the asset purchase agreement (APA) with Aqua.

In his letter, Aqua’s attorney, John F. Povilaitis with Buchanan Ingersoll & Rooney, highlighted a key part of Judge Patricia McCullough’s decision:

“[I]t is important to note that the County, in its demand that DELCORA terminate its operations and transfer its assets to the County, effectively places the County in a situation where it would receive a ‘contractual assignment’ from DELCORA as a matter of statutory law. Consequently, the County would, without question or condition, be bound by the terms and conditions of the [purchase agreement], just as if it were DELCORA itself in the sense that it would essentially become a ‘party’ to the contract.”

“Aqua respectfully requests that the Commission rule on the pending Petition as expeditiously as possible,” Povilaitis added.

As is often the case in politics, that depends on your definition of the word “expeditiously.” The PUC has to rule on the sale, and an administrative law judge panel has already recommended its rejection.

So, now what?

“The bottom line is that the county must comply with the existing asset purchase agreement between DELCORA and Aqua or face a lawsuit for specific performance and or breach of contract that we believe could reach hundreds of millions of dollars,” Aqua said in a statement to DVJournal.

Some county government observers say the current Democratic majority would be more than happy to avoid a lawsuit and collect a big check. They speculate the current fight is about leverage to force Aqua to sweeten the pot. With DELCORA dissolved, that cash would come straight to the county.

Delaware County Democrats say that is crazy because no matter how hard the story has been to follow, if local ratepayers suddenly see a spike in their sewer bills, they are going to blame the current council.

“The county had been consistent in its position that the transaction is unfair to ratepayers and taxpayers because there was nobody at the table looking out for their interests,” said Delaware County Solicitor Bill Martin.

As for restructuring the existing DELCORA board, attorney Frank Catania, who has often battled Aqua, has concerns.

“A person experienced in Public Utility Commission matters once told me that when dealing with the PUC, ‘If you don’t have a seat at the table, you will be on the menu.’ I hope that the new DELCORA Board will take strong action to protect the DELCORA ratepayers in the PUC proceeding and the remand to Delaware County Court,” Catania said.

And what about rate hikes? Aqua is touting a rate stabilization trust fund in its DELOCORA proposal similar to the one it says is in its bid to take over the Chester Water Authority. The idea is to set aside part of the purchase price to keep rates stable for the next few years.

And, like the Chester Water proposal, Aqua’s trust fund appears nowhere in the actual sales agreement. In other words, it is a pledge, but not a contract.

“The Trust is not part of the purchase agreement and it is up to DELCORA (and possibly the county, if they choose to dissolve DELCORA) to decide what will happen with the net proceeds from the sale,” according to Aqua’s statement. “DELCORA’s plan, as was explained to us, was to offset future rate increases by taking the $200 million in proceeds from the sale and give it back to customers through the use of a trust over the next 10 years.”

Martin describes the Aqua arrangement this way:

“The concept of the trust is that Aqua is paying the authority, but then the authority is setting aside part of the purchase to offset future rate hikes. It’s like someone saying, ‘I want to buy your car,’ then the buyer requires you to hold half the sale proceeds to pay for future repairs for the next 10 years. The net result is that they get the money, not you.”

Margo Woodacre says she has two words for promises from Aqua about protecting ratepayers: “Hog. Wash.”

Margo Woodacre is a co-founder of KWA – Keep Water Affordable, a group of New Garden residents who have seen their sewer bills soar since Aqua purchased the municipal system. She says Aqua came in with a promise of a two-year rate freeze and a cap on rate increases for ten years. It was a promise Aqua hasn’t kept, she told DVJournal.

“Aqua is a lot of talk,” Woodacre said. “They’ve got the money, they’ve got the connections, but I wouldn’t believe anything they say.”