by State Sen. Bob Mensch

In the movie “Groundhog Day,” the Pennsylvania weatherman played by Bill Murray famously lives the same day over and over. In “Groundhog Day: The State Budget,” Pennsylvania taxpayers live the same threat of massive tax hikes year after year.

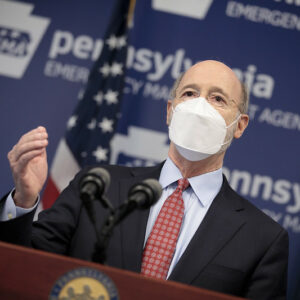

On February 3, one day after Punxsutawney Phil predicted six more weeks of winter, Governor Tom Wolf unveiled his proposed state budget, predicting at least six more weeks of Pennsylvanians fending off the largest tax and spending increases in state history.

The governor’s proposed 2021-22 state budget includes a $3.1 billion (8.2 percent) increase in state spending from the current fiscal year. This staggeringly large spending increase is unsustainable.

In addition, he wants to increase the state personal income tax (PIT) rate from 3.07 percent to 4.49 percent (a 46.3 percent hike) as of July 1. About one-third of all Pennsylvanians, would see their state tax burden increase under this rate hike.

This doesn’t only harm families. Upwards of one million Pennsylvania small businesses will have their tax rates increased, since these pass-through businesses (i.e. S corporations, partnerships, etc.) pay business taxes at the same PIT rate as individuals.

This proposed tax increase coupled with the governor’s ongoing COVID-19 restrictions and his proposed minimum wage hike would be devastating for many family businesses that are already struggling to stay financially solvent.

In addition, the workers who will lose their jobs because of these burdens will have to rely on the administration’s ineffective Unemployment Compensation system for help. This is a prescription for disaster.

Of course, not all businesses will be harmed by Governor Wolf’s plan. Amazon and large retailers don’t care about the personal income tax, but the small businesses that employ most of our workers will be hit hard.

It is also disappointing that even as Governor Wolf proposed nearly $3.1 billion in new government spending, he still saw fit to slash funding for school safety by $40 million.

The governor is proposing to cut several line items in the budget that have a direct impact on public health – even in the middle of a pandemic. These include cuts to regional cancer centers, chronic respiratory illness, leukemia and lymphoma, Lyme disease, ALS and many more.

Coupled with the botched COVID-19 vaccine rollout that has left Pennsylvania ranked 42nd in the nation in terms of distribution efficiency, the governor’s public health cuts could have a devastating impact on the health and safety of our communities.

The good news is that Governor Wolf’s budget address is only a suggestion. Taxpayers know that standing between the governor and smaller paychecks is a General Assembly that will, once again, fight to protect their earnings and their jobs, and restore funding to critical needs.

What we needed was a lean, smart budget that meets the state’s needs as efficiently as possible – not a proposal that would amount to the largest state spending increase in Pennsylvania’s history.

As a member of the Senate Appropriations Committee, I’ll be taking part in the public hearings that serve to examine the spending proposal and question the administration officials behind it.

The stakes are high.

Employment data proves that the governor shut down too many employers and too many sectors of our economy, and kept them closed for far too long. Our economy is still struggling to recover from these bad decisions Governor Wolf made without consulting legislators, industry experts, or local officials.

The governor’s budget plan would compound his previous errors and leave Pennsylvanians to repair the serious damage long after he leaves office. I will do everything I can to prevent further harm and set our district and commonwealth on the road to recovery.

Sen. Bob Mensch represents the 24th District, including parts of Montgomery, Bucks, and Berks counties.