(This article first appeared in Broad + Liberty)

The first draft of Delaware County’s 2025 budget shows the county operating with a $76 million deficit, according to a Broad + Liberty analysis of county budget documents.

In order to pay for $52 million of that gap, taxpayers are facing a 28 percent real estate tax increase. To fill the remainder, the draft budget spends $10 million in non-renewable funding from the federal government, and also dips into the county’s “fund balance” — essentially the reserve fund — for another $14 million.

The five-member county council, which flipped from a Republican to Democratic majority in 2020, will have the final say on any adjustments or changes to what Executive Director Barbara O’Malley has proposed. Yet the executive director’s draft budget is usually a reasonable predictor of the basic outline of the county’s anticipated spending and revenues.

The proposed 28 percent tax increase would come on the heels of a five percent increase already levied on county residents in 2024.

Warning signs that a subsequent tax increase larger than last year’s have been flashing for some time.

As far back as March, Councilwoman Christine Reuther said in a public meeting that the county was facing a “sizable tax increase” for 2025, but stopped short of giving any estimate.

In June, the credit rating agency Moody’s downgraded Delaware County’s rating, a decision that may have been based at least in part on Reuther’s comments in March.

“As Moody’s Ratings has downgraded Delaware County’s ratings because of the ‘unexpected weakening of the county’s financial position,’ at least one county council member is anticipating a tax increase at the end of the year to balance increasing costs,” the Delco Times reported.

“The downgrade captures the unexpected weakening of the county’s financial position,” Moody’s said when downgrading the rating from Aa1 to Aa2. “The county’s available fund balance is already an outlier to the downside relative to peers, and it expects to run a large deficit in 2024 with the exhaustion of federal stimulus aid.”

The “fund balance” referenced can essentially be thought of as the county’s reserves, or rainy day fund. According to Executive Director O’Malley’s budget, the county would use $14 million from the fund balance in the 2025 budget.

The other spending item lacking a continual revenue stream is $10 million in spending from the federal American Rescue Plan Act (ARPA), a bill passed in the midst of the pandemic intended to help local governments across the country deal with the turbulence. According to a webpage on the Government Finance Officers Association, ARPA funding “must be obligated by the end of calendar year 2024 and expended by the end of calendar year 2026.”

In other words, the county will not have the ability to dedicate any ARPA funds after this year. This is the same “federal stimulus aid” that Moody’s worried would be a problem for the county once the aid was “exhausted.”

Given that the $14 million from the fund balance and $10 million from ARPA are included in this year’s “operating budget” but are non-recurring sources of revenue, the county would still need to find revenue streams to cover those obligations by the 2026 budget or risk another sizable tax increase. Covering that $24 million in 2026 would equate to roughly an additional 13 percent tax increase, according to a Broad + Liberty analysis.

That worry about reliance on non-recurring revenues was previously detailed by an unidentified county employee who took notes on a county leadership meeting led by O’Malley from February.

“Our county has been in the habit of using one-time funds for ongoing operating costs,” the employee wrote in the four-page memo outlining the meeting. The memo was obtained through a previous Right to Know Law request.

The county charter requires the executive director to submit a budget to council sixty days before the end of the year. Despite the fact that the county has had this draft of the budget since the beginning of November, it hasn’t made the document available online. Broad + Liberty made photos of the executive summary of the budget while in person at the county’s open records office, but was unable to obtain a full copy of the document on Friday. It expects to have a full copy of the document Monday.

Councilman Kevin Madden was one of the first Democrats elected to the Delaware County Council in nearly a century and a half in 2017. One of his first suggestions was to have all county meetings recorded and related documents uploaded to the county website for posterity. “It’s not so much those measures will change things overnight, but they’re emblematic of a system that didn’t employ common sense best practices,” Madden said. “We ran on the idea that single-party rule prevents transparency and this is a time to make structural changes.” Madden also pledged not to raise taxes.

The county responded to issues related to the tax increase, the dwindling fund balance, and posting the draft budget, but did not answer other questions.

“Like many counties across Pennsylvania, we are faced with difficult decisions as the combination of inflation, utilization of one-time federal relief funding, increased demand for services, and flat revenue for more than the past decade has resulted in a structural deficit and dwindling fund balance,” a county spokesperson told Broad + Liberty. “We looked at every possible way to streamline operations and cut costs before asking the public for more support and we do not do so lightly. This County, like many others, incorporated the ARPA Revenue Loss funds into our budget during the past few years to avoid relying on tax increases from residents. Last year, Council made a small increase to revenue to reduce our reliance on one-time funds and minimize reduction of our general fund reserves.

“We recognize our residents are facing the same inflationary pressures that we are facing, but additional revenue is in our proposed 2025 budget that may be necessary in order for us to continue modernizing Delaware County’s government, repairing county infrastructure, and delivering the quality services that our residents deserve and expect. We are continuing to work to reduce any increase from our proposed budget that will be presented at our budget hearing.

“We are committed to putting the County on the path to be self-sustaining and begin restoring our fund balance. We will continue the work of providing the level of service that our residents deserve while keeping costs as low as possible. The County will share details on its budget at both the public hearing and the budget ordinance meeting; both meetings will be livestreamed and recorded for later viewing,” the spokesman concluded.

The county also provided a budget slideshow, pointing specifically to one slide showing that Delaware County’s revenue has remained relatively flat in comparison to its suburban neighbors like Bucks, Chester, and Montgomery counties.

Combining both the 2024 and 2025 budgets, the county will have spent $51.8 million from the fund balance. The county did not respond to a question as to what the fund balance was expected to be at the beginning of the new fiscal year on January 1.

The Democrats, who came to power in 2020 and many of whom still remain on the all-Democratic county council today, campaigned on promises to launch ambitious projects like the creation of a county-run health department and the deprivatization of the county prison.

Republicans warned some of those projects would be more costly than Democrats imagined — predictions that seem to be coming true.

For example, as the county was progressing towards deprivatizing the George W. Hill Correctional Facility, it received a financial analysis from a consultant discussing various cost scenarios. In the most expensive analysis presented, the county was expected to spend about $49.9 million to run the prison, but that assumed a full population. The county could reasonably run the prison for about $43 million if the daily population were significantly lowered, the consultant estimated.

According to the 2024 adopted budget, the net cost of running the GWHCF was $56 million. Additionally, that higher price tag came despite the fact that the county has successfully lowered the daily prison population by at least 20 percent over the last two years.

Other decisions by the county have put upward pressure on the budget.

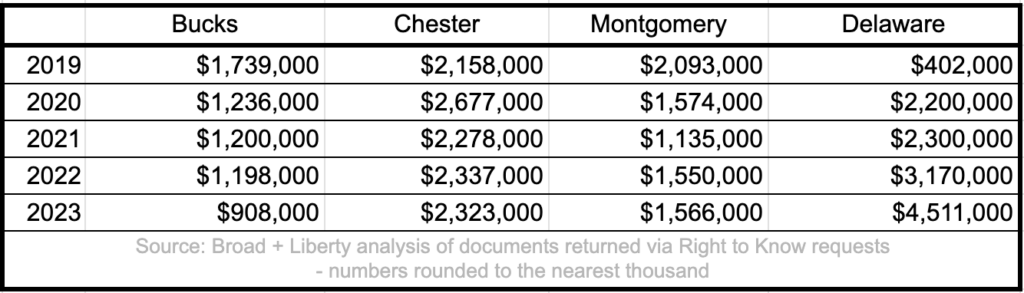

For example, as Broad + Liberty has chronicled for years now, the county’s use of third-party attorneys as opposed to in-house counsel has skyrocketed under the Democrats’ control. In the last year of Republican governance, spending on outside attorneys was about $400,000. In 2023, that figure had shot up to $4.5 million.

When confronted last week about budget issues, Councilwoman Elaine Paul Schaefer largely blamed inflation, and her Republican predecessors.

“That budget deficit doesn’t come from nowhere,” Schaeffer said, as reported by the Delco Times. “The leadership of this county before this current board did not raise taxes for twelve straight years and then, the thirteenth year before this council came in, they lowered taxes and decreased revenue coming in.

“So, it is no great mystery where the budget deficit came from,” Schaeffer continued. “There’s not a business in the entire world whether it’s profit, nonprofit, or government that can operate for over a decade with no increase in revenue commensurate with inflation. It just doesn’t work.”

Delaware County GOP Chairman Frank Agovino sees things differently.

“I am pleased that council Democrats have finally come clean and admitted what most of us have known for years. Out of control spending by the Biden-Harris Administration in DC and this council have resulted in crushing inflation and massive tax increases at a time when most Delco families can least afford it,” Agovino said.

“No one likes big tax increases, and very few people like one-party rule. Unfortunately, we have both right now in Delco. It’s time for county Democrats to be held accountable for their incompetence. Passing the buck to a Republican Party of yesteryear is pathetic and I’m confident voters will see right through their excuses in next year’s local elections,” he concluded.

It is not clear when the budget will be made available online for public inspection. If the standard for “public inspection” includes publishing on the county’s website, as was suggested previously by many current members of the council, then the Nov. 1 deadline established by the county’s Home Rule Charter was not met.

The county will discuss the budget at a 1 p.m. meeting on Dec. 3, and is expected to vote on a final version at the planned, regular council meeting on Dec. 11.