Senate candidate Dave McCormick called for a ban on access to social media for kids under 16.

“A study from the Centers for Disease Control last year found that 20 percent, one-fifth of 12 17-year-old kids have at least one major depressive episode,” McCormick said. “Researchers such as Jonathan Haidt have documented how addictive using social media is. It’s a major driver of mental health crises.”

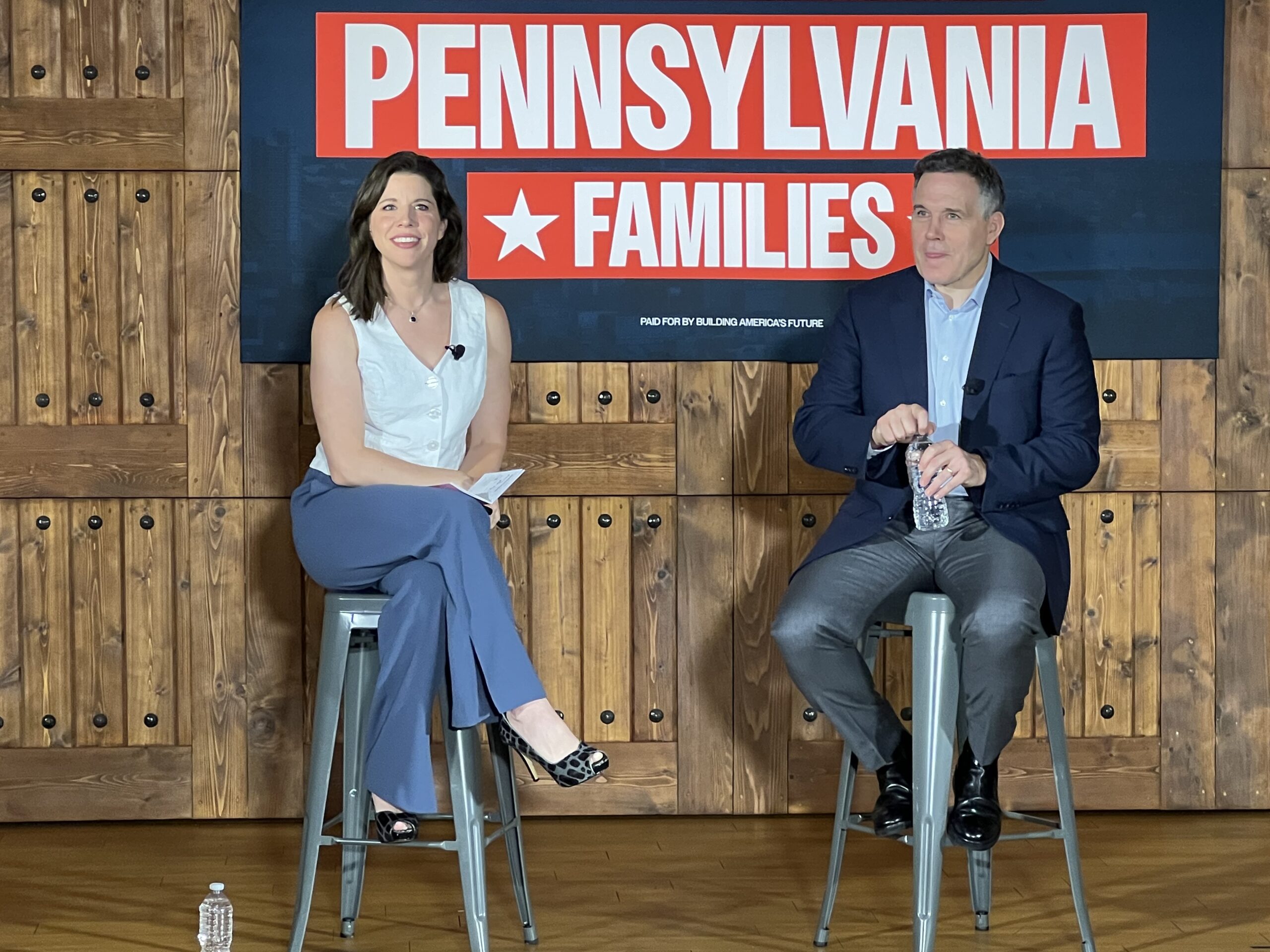

McCormick spoke at an America’s Future Tour event in Springfield hosted by Delaware County GOP Chair Frank Agovino. Fox News journalist Mary Katharine Ham, interviewed McCormick.

McCormick supports a federal school choice bill, the Educational Choice for Children Act. This would create a federal tax credit for businesses and citizens that provide money for scholarships for children in failing schools to move to better schools.

“Sen. Casey won’t support this legislation. He’s against giving kids in failing schools the ability to move to the school of their choice. And that’s because Sen. Casey is beholden to the same teachers’ unions that kept our kids out of the classroom for years during COVID,” said McCormick.

Dave McCormick

“Here’s what really made me angry. Sen. Casey went to parochial school. Yet he opposes giving his constituents in failing public schools the same opportunity. Pennsylvania deserves a senator who supports school choice because choosing where your child goes to school should not be a privilege that’s only reserved for the wealthy and well-connected parents.”

“We need to shake things up in a big way,” he said. The tax money should go with the child. “The beauty of that is it will increase competition…It’s going to be disruptive as hell, and it needs to be.”

In a wide-ranging policy talk, McCormick spoke about helping families at all stages of people’s lives, from subsidies for faith-based childcare, better access to healthcare for mothers and senior citizens, and more mental health care for veterans.

“Only 33 percent of Black children and 55 percent of Hispanic children grow up in two-parent families,” he said. “Kids in a single-parent home are five times more likely to live in poverty, more likely to have behavior issues, more likely to drop out of school.”

This is “leaving the American Dream out of reach for more and more families,” he said. “Children who are born to parents in the bottom fifth of family incomes have a 46 percent chance of remaining in the bottom fifth their whole lives and only a 3 percent chance of getting to the top fifth.”

“And Americans are even having fewer babies despite surveys showing that women wish they could have more. America cannot be strong if our families are weak. And if our families are in decline, America will decline. And we can’t let that happen.”

“For far too long, career politicians in Washington have made it harder, not easier, for working families in Pennsylvania,” he said. “Inflation is driving up grocery bills, the cost of housing, and other essentials. Childcare. It’s gotten so expensive it’s out of reach for many families.”

Mary Katharine Ham

“Under the watch of President Biden and Pennsylvania’s liberal Sen. Bob Casey, these problems are getting worse, not better. After 18 years in Washinton, Sen. Casey has not been a proactive leader. He’s been a rubber stamp liberal who votes with President Biden 98 percent of the time.”

McCormick wants to make it easier for couples to start families.

He said the average cost of having a child is $19,000, including $3,000 out of pocket. The average middle-class family spends $13,000 in a child’s first year.

“We need to make contraceptives more accessible and affordable for women so they can have children when they’re ready,” said McCormick. “I’ll always support access to in vitro fertilization to enable parents across our country to welcome children.”

When he was the CEO of Bridgewater, the company helped pay for fertility services for employees. “As your senator, I will oppose any effort to restrict IVF. Period,” said McCormick.

“Every family should get a $15,000 tax credit for fertility expenses, like IVF,” McCormick said. He would also promote adoption services, making the adoption tax credit created by the Trump tax plan fully refundable.

“It’s unacceptable that the United States has one of the highest maternal mortality rates in the world among wealthy nations,” he said. “The U.S. birth rate is also at a historic low. 1.6 children per woman. Far below the 2.1 average needed to keep our population in the U.S. from declining.”

“In Pennsylvania, at least five counties have no hospitals,” said McCormick, so women there lack easy access to maternity care.

Far too many Americans with severe mental health crises are not able to get the care they need,” he said. “Fourteen million Americans, approximately, have serious mental illnesses. More than half of them have their needs unmet, veterans in particular, something near and dear to my heart, as a veteran,” said McCormick. Some “22 vets a day take their own lives…Half of the veterans who commit suicide had no mental health treatment. We must expand mental health care for those with serious mental illness by getting rid of Medicaid rules that constrain access to psychiatric (help).”

“We need to support our seniors in retirement,” he said. “Let me be perfectly clear: our government needs to keep its promises to protect Social Security and Medicare.”

“I’ll always put problem-solving over ideology,” he said.

Asked about the additional doctors needed to expand healthcare, McCormick told DVJournal that more doctors and nurses are necessary.

“The nurse shortage, in particular, is really problematic,” he said. “So, it’s part of a skilled worker program to allow people to access healthcare education and encourage them to do it.

“And it’s unbelievable when you look at how long it takes to become a doctor and how hard it is to make ends meet. And they have hundreds of thousands of dollars of loans. So, we’re going to have to support people if they want to become medical professionals and support their education,” said McCormick.

Please follow DVJournal on social media: Twitter@DVJournal or Facebook.com/DelawareValleyJournal