Administration Wants to Have Steel Cake and Eat It Too

The Biden administration recently announced tariffs on Chinese steel imports — which are fine when he throws them around but xenophobic! when Donald Trump uses them. This is another instance where Biden shows he wants to have his cake and eat it too when pandering to Rust Belters, much like his resistance to the U.S. Steel/Nippon Steel deal.

Pennsylvania-based U.S. Steel has been entertaining bids for its business. A year ago, Ohio-based Cleveland-Cliffs offered $7.3 billion to buy the company. This offer that was quickly outmatched when Tokyo-based Nippon Steel offered $14.1 billion. U.S. Steel CEO David Burritt recently said this latter deal will likely go through this year.

Nippon Steel’s annual production is 44.37 million tons, while U.S. Steel’s is 14.49 million tons, according to data from the World Steel Association. If the two combined, like some kind of Japanese super-robot, they would become the third-largest steel producer in the world.

Now, Cleveland-Cliffs would prefer to acquire its domestic rival rather than see it plucked up by an international one. However, rather than pony up $7 billion more to outspend Nippon, it uses the much-cheaper alternative of election-year fearmongering to scare U.S. Steel into settling.

As well they might. Cleveland-Cliffs’s stock has been in a freefall, down 30 percent.

A downgrade of the stock’s value has been attributed to broader economic conditions, but analysts at Barrons also attribute this to operational missteps by CEO Lourenco Goncalves. The Zacks Ranks system put it as a rank 4/5 (sell).

Increasingly, the narrative is changing: U.S. Steel doesn’t need Cleveland-Cliffs to survive as much as Cleveland-Cliffs needs U.S. Steel. Opponents of the Nippon deal don’t want that narrative to change, imagining a 1950s-style Renaissance of domestic manufacturing if the Japanese investment deal can just be somehow stopped! This is a classic example of the fallacy of the false alternative. The truth is that no such Renaissance will happen.

Americans — and probably almost everyone else — attach a patriotic importance to manufacturing.

Opponents of the Nippon Steel deal are employing this kind of strategy now. Muscle-bound manufacturers at Bethlehem Steel played a slightly more pivotal role in winning World War II than the nerdy accountants at Ernst & Young.

Spoiler alert: WWII ended 80 years ago. And now, Japan is our No. 4 biggest trading partner. The Americans and the Japanese have been fast friends for decades.

If our domestic steel industry isn’t undergirded with this kind of capitalization, the much more significant threat is an oversupply of Chinese steel that cedes to the Communist Party there (yet) another advantage.

If the Nippon-U.S. Steel merger doesn’t go through, the most likely outcome is U.S. Steel breaking up into parts. Cleveland Cliffs will have to divest because of antitrust-happy Federal Trade Commission Chair Lina Khan’s “big is bad” attitude toward American corporations. While Nippon Steel has promised to maintain the status quo on domestic operations — except for moving the headquarters from Houston to Pittsburgh — the uncertainty of any other outcome is questionable for employees’ short-term job prospects and long-term retirement.

If a piece of U.S. Steel ends up in the hands of rivals from China or elsewhere, pensions won’t be as secure as they would be if the company stays whole. And it won’t influence the presidential election either way.

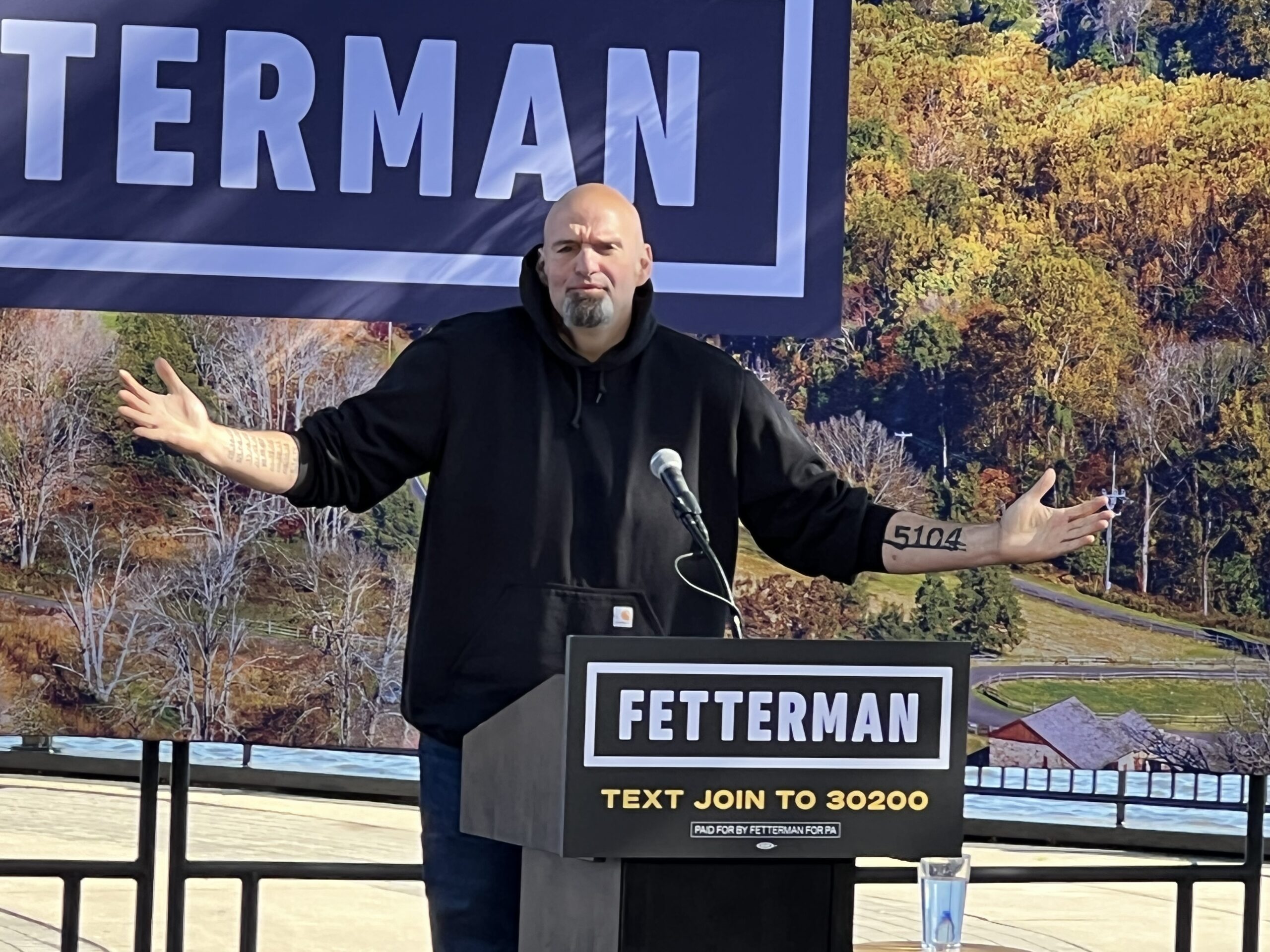

Businesses in swing states frequently get a lot of attention during presidential elections, with candidates competing to win independent voters with their economic message. Trump won Pennsylvania in 2016, lost it to Biden in 2020, and now enjoys a narrow lead there. Both have publicly stated they oppose the Nippon Steel acquisition.

The Nippon Steel-U.S. Steel merger would fix heavy problems in our domestic manufacturing industry. Election-year shenanigans from a struggling competitor shouldn’t be allowed to fix the blame.

Please follow DVJournal on social media: Twitter@DVJournal or Facebook.com/DelawareValleyJournal