Will Dem McClelland’s Opposition to School Choice Win Her Treasurer’s Job?

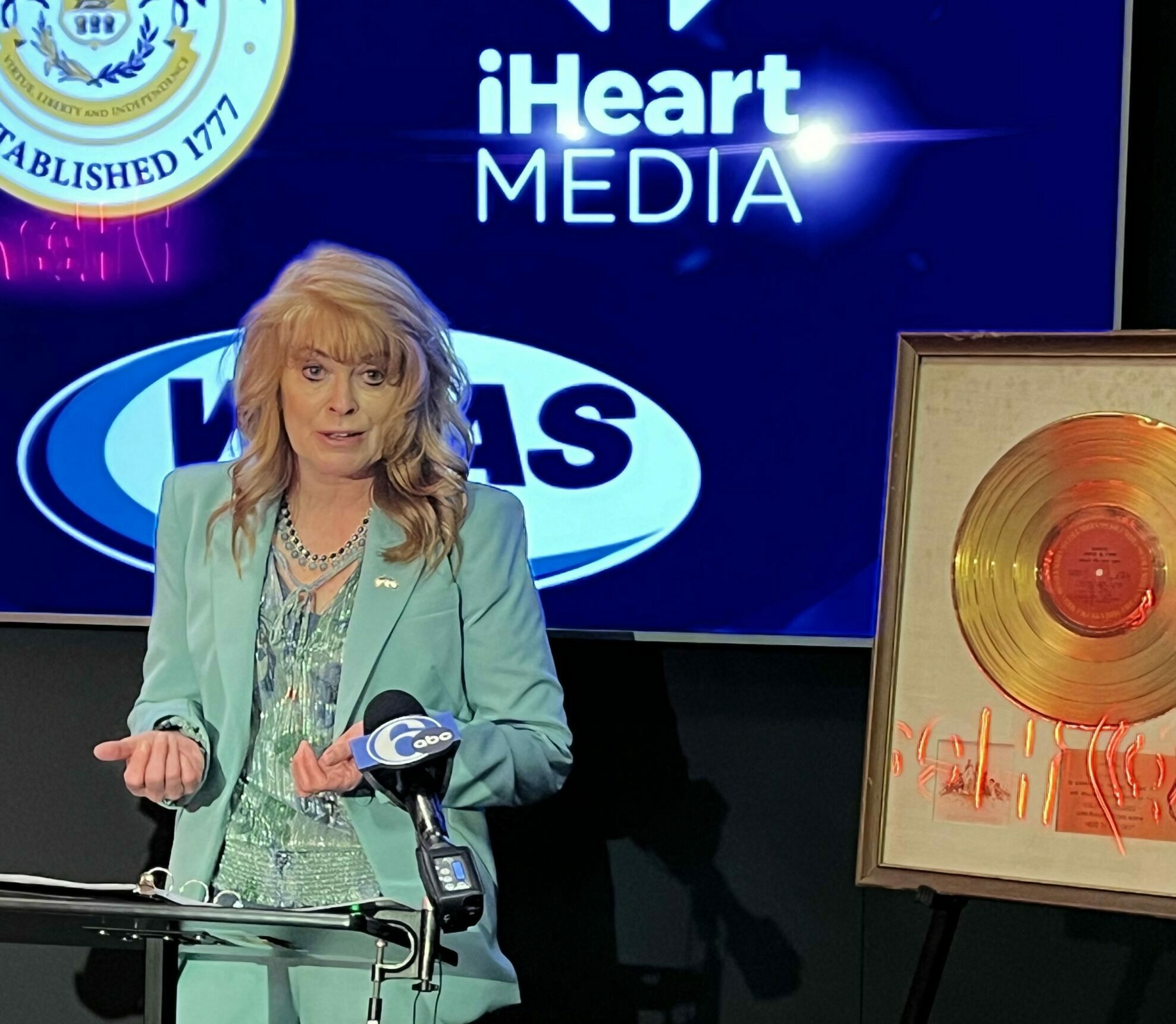

Democratic state treasurer candidate Erin McClelland wants voters to know she’s “aggressively against school vouchers,” and she’s making her opposition to parental choice in education a centerpiece of her campaign.

“If vouchers are passed, it is the treasurer that writes the voucher. And I can assure you that if that goes through, we’re going to court, and we’re going to fight it on constitutional grounds, and I’ll write the voucher when the Supreme Court of Pennsylvania tells me I have no choice,” McClelland said in a recent interview with abc27.

The debate over how much control Pennsylvania parents should have over their children’s education has been part of the state’s politics for decades. But such adamant opposition is rare from a statewide candidate.

It also shows a lack of understanding about the state treasurer’s job, says Jim Tkacik, campaign manager for incumbent GOP Treasurer Stacy Garrity.

“Erin McClelland is grandstanding. The treasurer’s job is to pay the bills and prudently oversee a $164 billion treasury. For Erin McClelland to suggest that she simply won’t sign treasury checks for programs she dislikes is reckless, illegal, and harmful to the state’s fiscal reputation. If Erin McClelland wants to oppose school choice, she should run for another office.”

It may also not be a winning issue for the Democratic challenger. Polls show that, in the wake of the COVID pandemic, support for school choice has soared. A March 2024 Commonwealth Foundation poll found 77 percent of Pennsylvania voters support Lifeline Scholarships, a state voucher program.

And education choice advocate Corey DeAngelis notes that “Morning Consult polling found 67 percent of Pennsylvania residents–and 74 percent of parents with school-age children–support school choice in the form of education savings accounts.”

“Gov. Josh Shapiro read the tea leaves. As I documented in my new book, ‘The Parent Revolution,’ Mr. Shapiro changed his education platform to include private school choice right before the 2022 election and even reiterated his support on Fox News last year. Joe Biden, who sent his own kids to private school, should follow Josh Shapiro’s lead if he wants to have a chance at winning Pennsylvania,” DeAngelis said.

Jenifer MacFarland. who is spearheading an effort to bring a classical charter school to the West Chester Area School District, said, “The ability for a parent to choose an educational program is critical to creating a highly educated society. When parents have a choice in programs for their children, competition between the providers improves educational programs everywhere.

“Wealthy parents have always had the option to place their children in private schools, but with school choice through public charters and vouchers for private schools, all children and families, regardless of income, have an opportunity to access high-quality educational opportunities for their children. Every voter who cares about children and improving educational outcomes for all kids should make it a point to vote their beliefs this Fall and make school choice a reality for the children, who are, after all, the future of the Commonwealth of Pennsylvania,” MacFarland added.

Like most of her fellow Pennsylvania Democrats, McClelland dismisses the value of vouchers.

“I think that they are a very bad Band-Aid,” McClelland said. “That doesn’t solve the greater problem.”

“Sadly, Erin is taking a page from the national Democrats’ playbook: make every race about national politics and about virtue-signaling, whether you’re running for dogcatcher or treasurer,” retorted Republican Guy Ciarrocchi, who is on the board of Pennsylvania Families for Educational Choice.

“She has hit a new low as her target is school children, with a platform so extreme she doesn’t even agree with Gov. Shapiro. Thankfully for taxpayers, Stacy Garrity has done her job as state treasurer well—without partisan politics.”

Please follow DVJournal on social media: Twitter@DVJournal or Facebook.com/DelawareValleyJournal