O’NEAL: Time for Big Ideas in Pennsylvania

This year has ushered in a lot of expensive talk in Harrisburg.

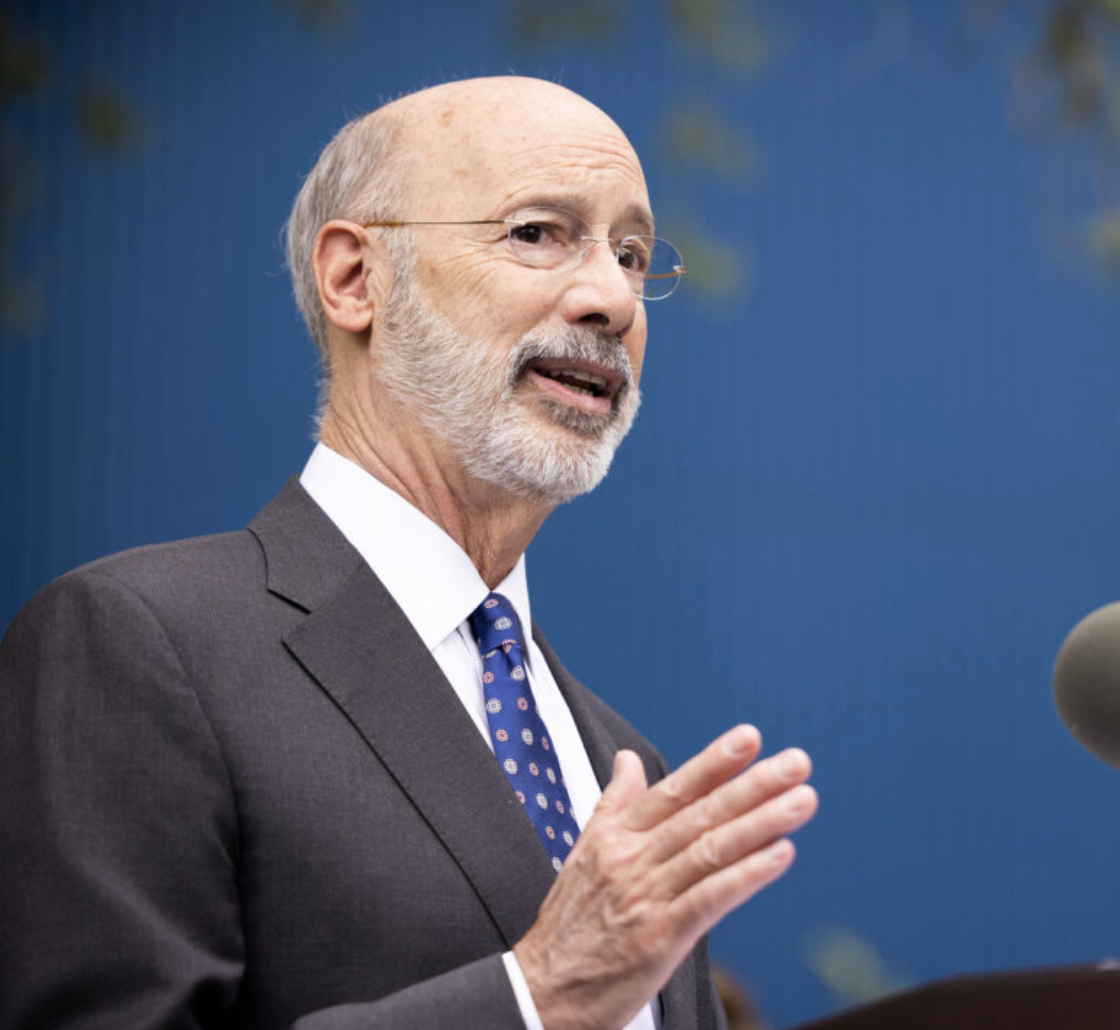

In just two months, we have seen Gov. Josh Shapiro and legislative Democrats push separate plans to increase taxpayer-funded spending by billions of dollars.

First, a partisan report from the Basic Education Funding Commission (BEFC) called for a $5 billion increase in education funding. Not to be outdone, Gov. Shapiro followed up with a whopping state budget proposal that spends nearly $50 billion, an 8 percent increase over the current year. In response, we have already seen warnings from media organizations that expensive proposals like this will lead to massive tax increases on all Pennsylvanians.

So, here we are again. The age-old argument that the best medicine for Pennsylvania’s problems is to throw more tax dollars into the void. Problem: The courts decided the system by which we fund public education is unfair. Solution: Spend more money! Problem: Pennsylvania is economically uncompetitive. Solution: Spend more money

This thinking is akin to topping off the gas tank of a car with a broken engine. No amount of money is going to mysteriously raise the test scores by which we judge whether or not our kids are learning. And no amount of money is going to magically make Pennsylvania’s archaic business policies more attractive to job creators.

Gov. Shapiro continues to traverse the state, saying he wants to “get stuff done,” and in his budget address, he called on the legislature to do more to help Pennsylvania compete with our neighbors. But his actions say the opposite.

Whether it’s fighting to protect an unconstitutional tax in court that will stifle energy production and cause utility costs to skyrocket or caving to special interests by vetoing hundreds of millions of dollars for poor kids in low-achieving schools, the governor has shown he’s willing to talk the talk but then walk in the opposite direction.

With that said, lawmakers cannot just be “no” on everything. We need to start thinking big to address the issues facing our Commonwealth. Pennsylvania is not going to tax and spend its way to economic prosperity, but we are also not going to make people’s lives better by doing nothing.

Instead of enacting the governor’s plan and forcing tax increases on Pennsylvanians, why don’t we let folks keep more of their hard-earned money? Recently, I circulated a legislative memo to reduce the Personal Income Tax that has received bipartisan support. As costs continue to rise, people deserve to keep more of what they earn and not have to worry about increases in their tax bills.

Now is the time to make monumental changes to our education system because what we have is clearly not working for everyone. According to the U.S. Census Bureau, in 2021, Pennsylvania ranked in the top 12 in state spending per pupil. Furthermore, the Commonwealth Foundation points out that Pennsylvania’s per-pupil funding increased to $21,263 in the 2021-22 school year, up from 37.6 percent since 2013.

And while we have consistently increased state funding for education by record amounts over the years, we have continued to see students’ test scores lag. What if we gave students in underperforming schools that $21,000 and just see if they can’t find a better place to learn?

While we’re looking at how we fund public education, we should finally tackle property tax reform. For years, families and seniors on fixed incomes have had to deal with this ever-increasing burden. Now, as mortgage rates and home prices rise, young people can’t even begin to think about getting that first home at all. Property taxes are just another massive barrier preventing many from achieving what was once the pinnacle of the American Dream.

Finally, if we want Pennsylvania to compete economically with our neighbors, let’s put forth policy that actually puts us in their league. According to the Tax Foundation, Pennsylvania ranks 31st in tax competitiveness for job creators.

Let’s accelerate the reduction of the Corporate Net Income Tax, something Gov. Shapiro has said he supports, and let’s do it without anti-business poison pills like combined reporting. Let’s finally tackle real permitting reform with reasonable timelines for approval so that businesses can actually responsibly plan ahead in Pennsylvania.

If the governor wants to “get stuff done,” House Republicans are ready and willing. But he should come up with better ideas than emptying the state’s reserves and increasing taxes on Pennsylvanians. Now is the time for big change, so let’s “get it done.”