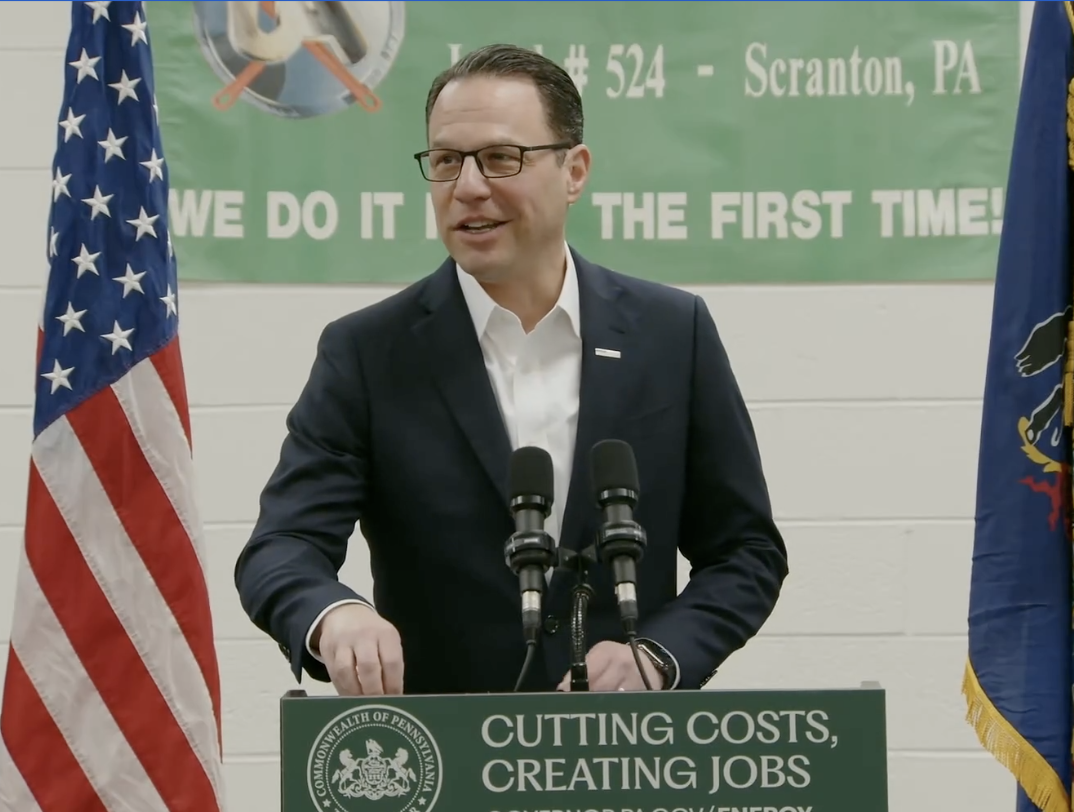

On Aug. 12, 2024, Gov. Josh Shapiro introduced the Streamlining Permits for Economic Expansion and Development (SPEED) program, which was supposed to expedite the permitting process for businesses. “Pennsylvanians deserve a state government that moves at the speed of business and processes their permits quickly to ensure Pennsylvanians receive a timely response,” Shapiro said. Yet, SPEED was […]