Upper Darby’s Earned Income Tax off the Table–for Now

Upper Darby taxpayers may have dodged a bullet.

Lame duck Mayor Barbarann Keffer, a Democrat, had proposed the township adopt a 1 percent earned income tax (EIT), bringing dozens of unhappy residents to meetings to complain. They opposed a tax increase amid inflation and other economic woes.

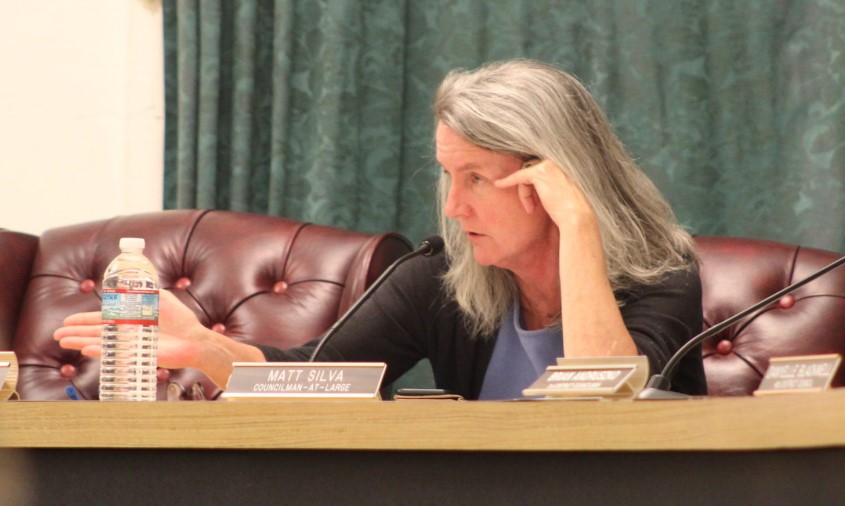

A vote on the EIT was scheduled for Nov. 29. But Keffer failed to properly introduce the ordinance, so it was postponed. Perhaps, indefinitely, said Republican Council President Brian Burke. He believes Keffer does not have the votes she needs to pass it.

“There’s nothing good about it,” said Burke, about the possible new tax.

Council also drafted a revised budget discussed on Nov. 29 that will be on the agenda on Dec. 6, he said. That $88,717,242 general fund budget includes money for nine new police officers, a key item Keffer wanted to fund through the EIT.

Keffer did not respond to DVJournal’s question about whether she planned to try to get the EIT through the council in the last month of her administration.

A Drexel Hill resident told the council at the Nov. 15 meeting that the EIT is a bad idea.

“The financial burden on residents, we have Bidenomics going on, high inflation, and we suddenly might enter World War III,” he said. “Adding an extra tax like this will make it a lot worse. A lot of my fellow residents are living paycheck to paycheck.”

A woman said, “I wholeheartedly oppose the tax.”

The audience applauded another woman when she said, “Do something about crime. Don’t keep asking us for more money.”

John DeMasi, a resident, said the EIT would hit residents making $15, $16, or $17 an hour the hardest. He said rent is up “double digits,” and credit card interest rates have climbed 6 or 7 percent.

“They’re not just getting a raise because all of these things are going up,” said DeMasi. “And you are going into their wallet and saying, ‘Give us 1 percent more.’”

He added, “It’s going to affect me and my family, yes. Are we looking to move? Yes. Do we have that ability? Yes.” But many residents can’t afford to move, he said.

“I strongly encourage you to find other ways to cut… We have seen disastrous spending,” said DeMasi. “The only person getting rich by default is the solicitor.”

Making her case for the new tax, Keffer said, “The EIT is part of a multi-pronged financial strategy to secure the future of Upper Darby, which includes the implementation of the realty transfer tax two years ago, the inclusion of third parties to manage delinquent taxes and fees and the business privilege tax as well as a stronger project and purchase bidding process which has resulted in higher revenues and lower costs over the last four years.”

The EIT would generate $9 million in new revenue in the first year.

She said property taxes would be frozen for 2024; seniors on fixed incomes would not pay it, and it would spread the cost of services more evenly. Funding for five new police officers and pension and retiree health care costs would be included.

Revenue that now goes to other towns with the EIT would return to Upper Darby. A state Department of Community and Economic Development report recommended the EIT.

The EIT does not apply to interest earnings, dividends, Social Security, capital gains, lottery winnings, unemployment, third-party sick pay, insurance proceeds, gifts, bequests, inheritances, and active military duty pay.

Council Vice President Hafiz Tunis supported the EIT.

“The 1 percent Earned Income Tax will put our township in a stronger financial position. With the EIT, we can take the burden off our seniors, invest more funds in our police department, and bring back revenue to our community that has been invested in other communities for decades. I would like to applaud the Keffer administration for this proposal,” he said.

Please follow DVJournal on social media: Twitter@DVJournal or Facebook.com/DelawareValleyJournal