The Delaware County Board of Assessment was ordered by Delaware County Court of Common Pleas Judge (Charles) Burr, to conduct a countywide real estate valuation reassessment in March 2017.

The court determined property values have changed since the last reassessment in 2000, which created inequities in real estate value in Delaware County. However, county Councilwoman Christine Reuther stated the county “cannot and will not . . . alter valuations.”

In essence, the court determined some property owners were paying too little in ad valorem taxes (which are taxes assessed according to value) while other property owners were paying too much.

In December 2017, the Delaware County Council contracted with Tyler Technologies to provide property appraisal services for the countywide reassessment of more than 200,000 properties. That valuation reassessment is now complete and the new assessed values will be effective for the 2021 tax year.

In June, local school tax bills were distributed and as many Delaware County residents had feared, some homeowners will have to pay significantly more in real estate taxes.

That increase is largely attributable to a valuation shift to residential properties.

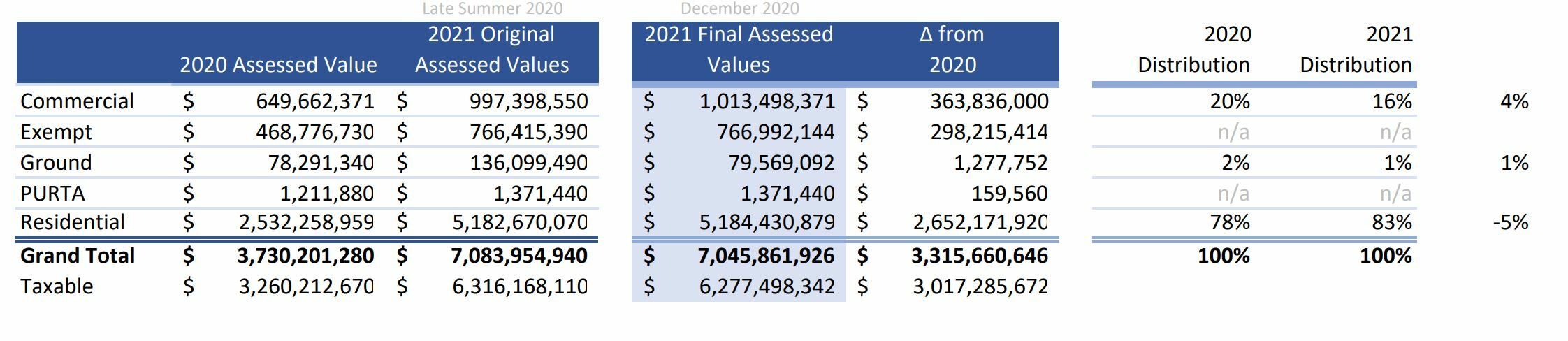

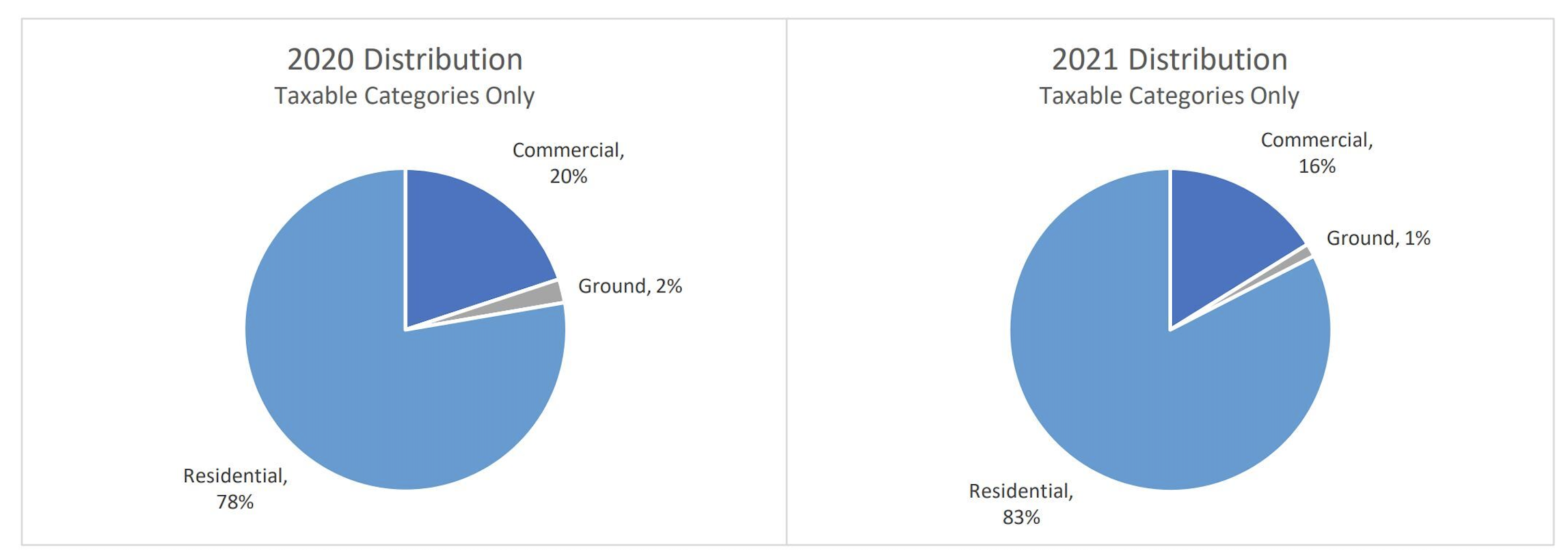

In my home of Radnor Township alone, there was a significant shift in relative values from commercial to residential properties. Based on a comparison completed by the Radnor Township staff, it was determined the assessed property values were unbalanced in 2021 relative to 2020. In fact, the share of Radnor Township’s residential real estate owners’ property values as a whole, went up from 78 percent of the total to 83 percent. (See chart.)

Commercial properties and undeveloped ground total valuations dropped from 20 percent to 16 percent and from 2 percent to 1 percent respectively, year over year. (See chart.)

Because the overall tax dollars collected by the various jurisdictions must remain “revenue neutral”, this shift in total valuation allocation means that collectively, Radnor’s homeowners will be paying a greater share of the overall tax burden of the ad valorem taxes collected, relative to prior years.

Most townships in Delaware County have other sources of revenue (such as business and mercantile taxes, transfer taxes, permit fees, etc.); however, property taxes make up the majority of local government tax collections.

Because Radnor’s school district and township are co-terminus, this tax burden shift affects both the township and school district tax bills. Therefore, in Delaware County townships like Radnor not only will homeowners’ tax bills go up, residential property owners will also receive a concurrent increase in school taxes.

Several school districts in Delaware County have flatly stated the shift in property values is an “inequitable” redistribution of the tax burden.

The Radnor School Board published a statement last summer stating its analysis of the reassessment valuations “revealed an unfair and inequitable shift of the total real estate tax burden to our District’s residential property owners . . . .”

According to the statement, Radnor School District residential property owners previously paid 79.8 percent of the total real estate tax burden, but under the new assessment, they would be responsible for 84.3 percent. They calculated that results in a 4.5 percent increase in valuation, which equates to a 5.6 percent increase in the overall tax burden borne by residential real estate owners.

The Radnor School Board went on to state that “[p]ractically speaking, there is a concern that . . . the typical Radnor residential taxpayer would see between a 30 to 50 percent tax increase on their school bill without our board ever enacting a tax increase at all . . . .”

Radnor is apparently not alone in this “inequitable” redistribution of ad valorem tax allocation. At least two other Delaware County school districts have declared that the reassessment is causing a negative impact to homeowners stemming from reassessment, increasing the burden of real estate taxes for residents.

The Marple Newtown and Springfield school boards also see the reassessment valuation allocation as an “unfair and inequitable shift” of the real estate tax bill to residents.

Marple Newtown School Board stated that this is an “inequitable shift of the total real estate tax burden to our district’s residential property owners.” In its case, residential property owners previously bore 78.99 percent of the total real estate tax burden, but that percentage increased to 80.91 percent under the reassessment, which constitutes a 1.92 percent increase in values and 2.43 percent increase in the district’s residential property owners’ tax burden.

Similarly, the Springfield School Board directed its attorney “to initiate and prosecute appropriate legal action to attempt to remedy the unfair and inequitable shift of the real estate tax burden to the District’s residential property owners that has resulted from the countywide reassessment.”

Based on the statements emanating from these three Delaware County school districts, and my own analysis of the Radnor Township ad valorem tax valuation distribution, my opinion is that the reassessment in Delaware County has in fact resulted in a redistribution of tax liability, from commercial to residential taxpayers (at least within the discrete areas municipal jurisdictions indicated).

While there is no increase in total dollars of the ad valorem taxes collected by each municipal jurisdiction, the relative tax burden has shifted; and in at least these locations in general, homeowners will see a relative increase in their real estate tax bills going forward.

In my role as a lawyer, I have handled many commercial reassessment appeals, in several different states. My experience has been that generally when reassessments occur, any shift in value goes towards increasing commercial property values. That is ostensibly because commercial property owners represent a far smaller voting bloc, than residential. That is, as a political matter, increasing residential tax rates is typically to be avoided, based on the rational assumption that increasing residential property taxes tends to hurt the majority party for that jurisdiction.

Apparently, in the current circumstance, the Democrat-controlled Delaware County Council does not have any qualms about raising residential real estate taxes on its residents.

It remains to be seen what effect this “inequitable” redistribution of tax liability will have politically within Delaware County. However, one might guess, that increasing property taxes on the single largest voting block (residential property owners) will be detrimental to the current Democrat majority.