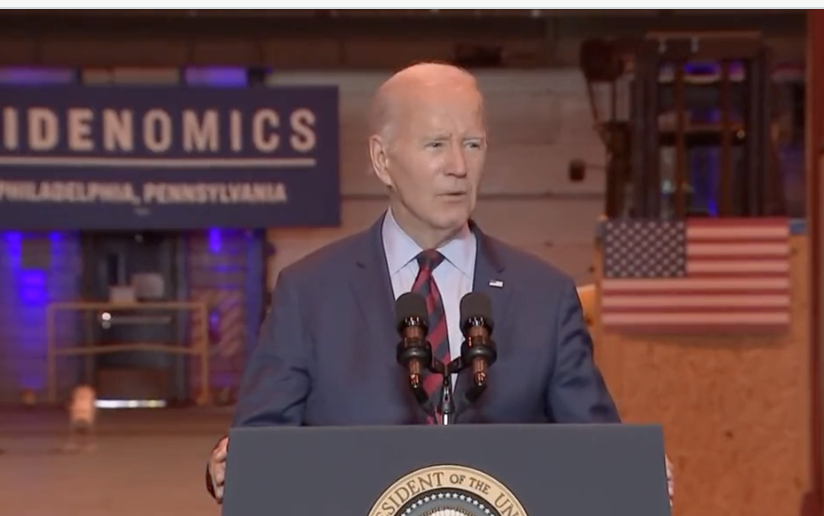

One day after Pennsylvanians filed their income taxes, President Joe Biden visited his hometown of Scranton on Tuesday and promised to cut middle-class taxes if given another term.

Biden will also visit Pittsburgh on Wednesday and Philadelphia on Friday—the eighth time the president or vice president will have come to Pennsylvania this year, according to his campaign. It’s yet another sign of the key role the Keystone State will play in the Electoral College in November.

Former President Donald Trump was in the Lehigh Valley on Saturday.

During a Monday press call, Biden campaign officials bashed Trump for the tax cuts he enacted in his first term, saying they favored billionaires and corporations. Former National Economic Council Director Brian Deese said that if Trump were reelected, he would bring “a plan our economy and our country simply can’t afford.”

He said Trump would extend the tax cuts for high-income individuals and give billionaires more than $3.5 million in tax relief every year. That would come by repealing the Affordable Care Act. They said Trump would also give large corporations a $1.5 trillion “windfall,” letting them use special loopholes to pay little or nothing in taxes.

Biden and Vice President Kamala Harris would also increase taxes on millionaires by 25 percent to make the “wealthy” pay “their fair share” toward Medicare, Deese said.

In fact, the Tax Foundation reports top earners are already paying a disproportionate share of taxes.

“The current federal tax system is highly progressive. For the individual income tax alone, the top 1 percent of earners pay about 45.8 percent of total income taxes, and the top 10 percent of earners pay nearly 76 percent of total income taxes, said Garrett Watson, senior policy analyst with the Tax Foundation.

“Looking at the federal tax system overall, the federal tax rate in 2019 began at 0.5 percent for the bottom 20 percent of earners to a 30 percent effective tax rate for the top 1 percent of earners, which show the system is progressive. The share of all federal taxes paid by the top 1 percent stands at about 25 percent, up from an average of 14.3 percent in the 1980s,” Wilson said.

“We have also looked closely at the entire tax and transfer system within the U.S, including non-tax transfers at all levels of government,” he said.

“The lowest quintile experienced a combined tax and transfer rate of negative 127.0 percent, meaning that for each dollar they earned, they received an additional $1.27 from the government, netting transfers (gains) and taxes (losses), while the top quintile had a rate of positive 30.7 percent, meaning on net they paid just under $0.31 for every dollar earned,” he said.

The Biden campaign also charged that Trump would help wealthy tax cheats by repealing the $87 billion Democrats have dedicated to increased IRS audits.

“You’re…allowing tax cheats to operate with impunity,” said Deese.

However, according to The Wall Street Journal, 63 percent of new audits last year targeted the middle class, despite promises audits would be aimed at those making $400,000 or more.

And Biden’s proposed $7.3 trillion fiscal year 2025 budget includes a $4.9 trillion tax increase.

“This is a classic tax-and-spend budget that continues large deficits even after big tax hikes,” according to Brian Riedl of the Manhattan Institute.

Dan Kanninen, Biden’s campaign battleground states director, said the Biden campaign has seven offices in the Delaware Valley and is aggressively reaching out to voters.

Kanninen said Biden has helped “create half a million jobs” in Pennsylvania.

“We’re building roads and bridges across the state. Meanwhile, Trump and his MAGA allies in Pennsylvania are saddled with a deeply unpopular agenda,” he said.

“Trump’s MAGA brand has become toxic in the Philadelphia suburbs, which are key swing areas that decide any Pennsylvania race statewide,” he said. Despite recent losses in statewide races, Republicans are becoming “more extreme,” he said. While Democrats are winning on their pledges to safeguard democracy, abortion and LGBTQ rights, he said.

Trump Campaign National Press Secretary Karoline Leavitt said the important issue is the economy.

“President Trump proudly passed the largest tax cuts in history. Joe Biden is proposing the largest tax hike ever which would take nearly $40,000 away from the average American family who is already losing thousands every year due to Biden’s record-high inflation crisis.

“When President Trump is back in the White House, he will advocate for more tax cuts for all Americans and reinvigorate America’s energy industry to bring down inflation, lower the cost of living, and pay down our debt.”

Please follow DVJournal on social media: Twitter@DVJournal or Facebook.com/DelawareValleyJournal