If President Joe Biden forgives $1.7 trillion of debt for college loans, will Delaware Valley’s congressional delegation be with him?

So far, it’s a mixed bag.

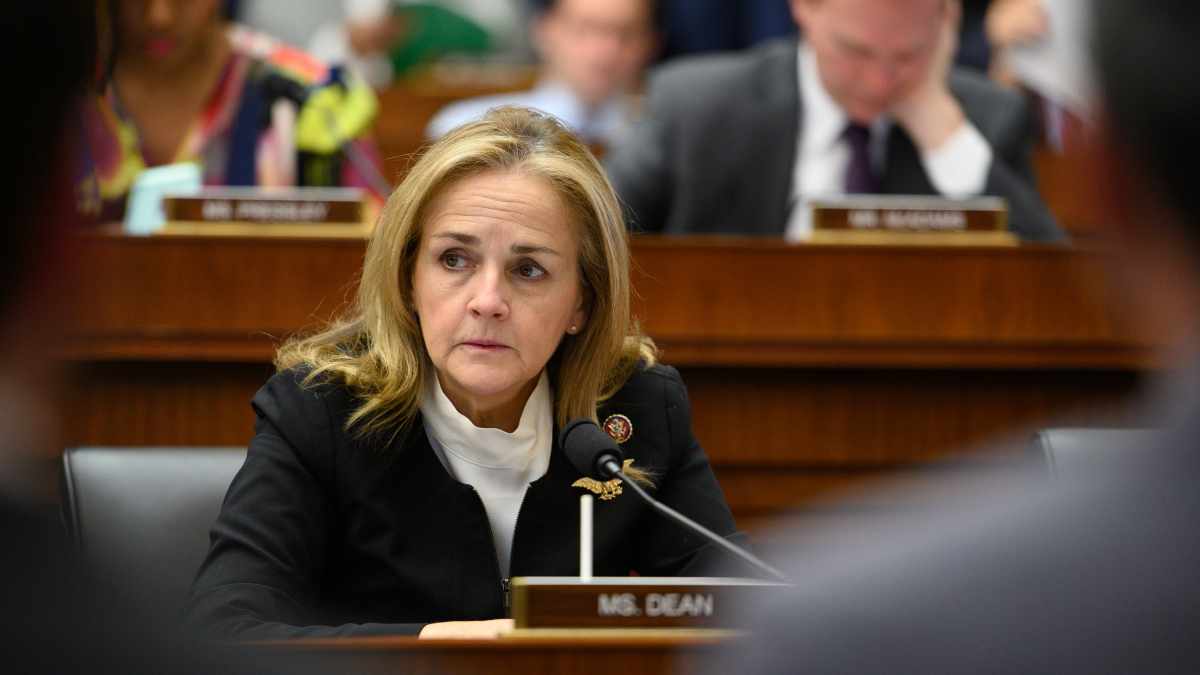

Rep. Madeleine Dean (PA-04) signed a letter urging President Biden to cancel $50,000 in federal student loan debt per borrower. The letter was led by Senate Majority Leader Charles Schumer (D-N.Y.), Senator Elizabeth Warren (D-Mass.)

Rep. Chrissy Houlahan (PA-06) on the other hand, has been more modest in her public stances, supporting targeted debt relief for people who choose to go into public service.

And Rep. Mary Gay Scanlon (PA-05) also supports targeted programs and allowing debtors hurt by the pandemic to file for bankruptcy and discharge their college loans. “Why are we providing protections to banks and servicers of student loans? Given where we’re at now, it has to change,” Scanlon said.

Supporters of shifting the cost of college debt onto taxpayers say it will help the economy. “Student loan debt is holding back tens of millions of people across this country who can’t buy homes, buy cars, or start small businesses,” Warren said via Twitter. “President Biden needs to #CancelStudentDebt not only for those people individually but also for our whole economy.”

While still a candidate in 2020, Biden also said he supported “an immediate cancellation of a minimum of $10,000 of student debt per person, as proposed by Sen. Warren,” The estimated price tag, according to the New York Federal Reserve, would be $321 billion. A proposal to forgive $50,000 of debt per borrower would cost taxpayers $904 billion.

And the vast majority of that money would go to Americans who are wealthy, suburban, and White.

“The highest-income 40 percent of households (those with incomes above $74,000) owe almost 60 percent of the outstanding education debt and make almost three-quarters of the payments,” according to the left-leaning Brookings Institution. “The lowest-income 40 percent of households hold just under 20 percent of the outstanding debt and make only 10 percent of the payments.”

And National Review’s Jim Geraghty points to this data from the New York Federal Reserve:

- Despite being 25 percent of the population, borrowers who live in high-income neighborhoods hold 33 percent of federal balances, while borrowers residing in low-income areas hold only 23 percent of balances.

- Under a $10,000 forgiveness policy, 33 percent of forgiveness would go to majority-minority neighborhoods while 67 percent would go to majority-white neighborhoods.

Student loan borrowers have already enjoyed a COVID-19 holiday from loan payments at an estimated cost of $100 billion to taxpayers, according to the Committee for a Responsible Federal Budget (CRFB). That holiday has been extended until September due to alleged economic hardship, despite the fact unemployment among college graduates is just two percent.

Advocates of fiscal responsibility have spoken out against the debt forgiveness proposal.

“Most people don’t have any college debt, because most people don’t go to college, or they already paid theirs off,” CRFB senior policy director Marc Goldwein said. “So they get nothing. Meanwhile, forgiving college debt helps a small but significant share of the population a little bit, and a very, very small share of the population a lot.”

That very small share is disproportionately made up of people who took out big loans to pay for graduate programs.

“Someone else can address the politics, but I know I’m not really interested in a policy that sends a lot of money to doctors, lawyers, and MBAs but nothing to people who didn’t go to college,” Goldwein said. “That’s especially true at a time when voters understand inflation is high because of excessive government spending. And forgiving student loans is definitely government spending.”

Meanwhile, the Association of Pennsylvania State College and Universities Facilities (APSCUF), the union for faculty and coaches at Pennsylvania State System of Higher Education Universities, approved a statement this month calling on President Biden to cancel all federally held student loan debt.

“Student debt is a Pennsylvania crisis,” the organization claims.

Interestingly, a new national poll released Monday by the Institute of Politics at the Harvard Kennedy School shows only 38 percent of 18-29-year-olds support total debt cancellation.

The real danger for Democrats is that, while young people may praise the debt forgiveness program, they don’t vote — at least, not as often as older voters. And those voters — particularly those over 50 — tell pollsters they don’t like wiping out debt and forcing others to pay the tab.

Retiring U.S. Senator Pat Toomey is no fan.

“What about all the other categories of debt that would not just be forgiven? What about the fact that some kids that borrow money come from very affluent families? You’re going to forgive their loans too? That doesn’t make sense to me,” Toomey said.